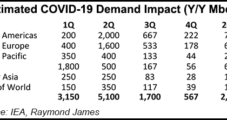

The impact of Covid-19 on pressuring U.S. natural gas prices remains a wildcard, but supply/demand changes point for the strip to move lower this year before 2021 ushers in “extremely bullish” prices, Raymond James & Associates Inc. said Monday.

Raymond

Articles from Raymond

NGI The Weekly Gas Market Report

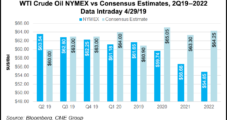

Raymond James Sees WTI Falling into $20s in 2Q on Covid-19, Price War

Extraordinary measures are continuing to slam the oil and gas markets, as more North American producers, including EQT Corp. and EOG Resources Inc., are announcing cuts to spending while oil prices — and demand — are slaughtered.

Lower 48 Well Productivity Sputters in 2019 as Decline Curve ‘Steeper Than We Thought’

Well productivity in the Lower 48 jumped in 2018, but output last year appeared to slide, implying the decline curve may be steepening relative to years’ past, according to Raymond James & Associates Inc.

Crude Oil Rally May Have Staying Power as Iraqi Attacks Stoke Supply Fears

Fears of escalation in the Middle East following a U.S. attack in Iraq early Friday, which killed a high ranking Iranian military leader, could support a sustained move higher for crude oil prices, which jumped 4% on Friday.

NGI The Weekly Gas Market Report

Supply Cuts Have Analysts Eyeing $100 Brent by 2020; Bearish Headwinds for NatGas

The global crude oil market could be headed for an “unprecedented” undersupply condition by 2020, suggesting further upside for West Texas Intermediate (WTI) and Brent even after prices rallied off the lows from late last year, according to analysts.

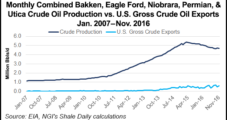

U.S. Shale on Call to Meet Global Oil Demand as FIDs Slow, Says Raymond James

Oil and natural gas startups worldwide should continue to deteriorate this year, resulting in an even bigger call on U.S. shale to meet global demand growth over the next decade, a review by Raymond James & Associates Inc. has found.

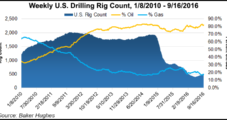

Onshore Rig Count On Track to Double? E&P Cash Flow Rising with Activity, Says Raymond James

U.S. producers may have enough cash flow this year to double the onshore rig count from current levels, Raymond James & Associates Inc. said Monday. The only thing standing in their way could be a lack of pressure pumping equipment.

‘Economics Will Eventually Win Out’ For Pipelines Facing Delays, Analysts Say

When it comes to the recent string of negative headlines for midstream projects facing opposition and delays, Raymond James & Associates Inc. said this week it thinks market fundamentals “and straightforward economics will eventually win out.”

U.S. E&P Cash Flow, Spend Trending Much Higher in 2017, Says Raymond James

U.S. exploration and production (E&P) cash flow generation and oilfield spending on drilling and completions have bottomed, no matter what direction oil and natural gas pricing goes in 2017, Raymond James & Associates said Monday.

Depleted Frack Capacity to Cap U.S. Rig Count at 800 in 2017, Says Raymond James

Pressure pumping attrition, brought about by financial stress on oilfield operators and equipment wear and tear likely will constrain the U.S. rig count into 2017, Raymond James & Associates said Monday.