NGI The Weekly Gas Market Report | Coronavirus | Markets | NGI All News Access

Raymond James Sees WTI Falling into $20s in 2Q on Covid-19, Price War

Extraordinary measures are continuing to slam the oil and gas markets, as more North American producers, including EQT Corp. and EOG Resources Inc., are announcing cuts to spending while oil prices — and demand — are slaughtered.

U.S. production is forecast to “bear the largest impacts” through 2021 from Covid-19 and the price war now ongoing between the Organization of the Petroleum Exporting Countries and former ally Russia, IHS Markit researchers said Monday. U.S. oil output alone is forecast to crater by 2-4 million b/d over the next 18 months.

“The last time that there was a global surplus of this magnitude was never,” said IHS Markit’s Jim Burkhard, head of oil markets. “Prior to this the largest six-month global surplus this century was 360 million bbl. What is coming will be twice that or more.”

The “current situation points to the possible buildup of the most extreme global oil supply surplus ever recorded,” the IHS team said. The coronavirus has reduced global energy demand, but it also has collided with the oil price war launched earlier this month.

“Counting barrels is challenging enough under normal circumstances, but the looming imbalance on current trajectory between demand and supply is so large now that it is well beyond any typical margin of error or uncertainty about data,” IHS researchers said.

The global oil supply surplus could be 4-10 million b/d from February to May, with demand in March and April alone possibly declining by as much as 10 million b/d, according to the consulting firm.

The estimated global oil surplus, said IHS researchers, could translate into an inventory build of 800 million-1.3 billion bbl in the first six months, foreshadowing the impact of increased travel restrictions, reduced community and the increasing likelihood of a severe global economic slowdown in 2Q2020.

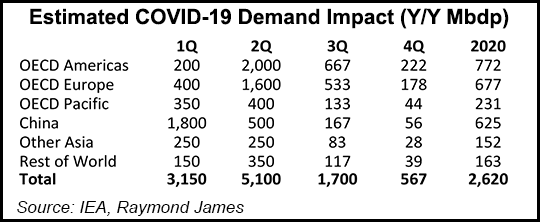

Raymond James & Associates Inc. analysts Pavel Molchanov and John Freeman on Monday said the fact that equity markets have entered bear territory doesn’t make the oil crash “feel” any better. The firm has cut its 2020 oil price forecast for the third time in three months.

The oil market is likely “to get much worse in the near term,” with West Texas Intermediate (WTI) likely testing $20/bbl in 2Q2020 “before rebounding strongly in the second half of 2020” and exiting the year at $45-plus.

“First, the cure for low oil prices is low oil prices, and next year we are forecasting a meaningful decline in U.S. production (and in other short-cycle producing countries as well),” Molchanov and Freeman wrote. “Second, the Saudi-Russia price war is largely political, and also self-destructive, so we expect it to be short-lived. Third, as hard as it may be to believe now, Covid’s demand impact will also subside over time.”

The WTI futures strip, said the Raymond James analysts, indicates quarterly prices below $40/bbl until 3Q2021. Lower 48 exploration and production (E&P) companies have responded by pulling back activity.

“Under this scenario, we expect the rig count to be cut in half, from 800 rigs at year-end 2019 to 400 rigs by the middle of 2020, and exiting 2020 at 390 rigs,” said the analysts. “With the strip recovering to a level above $40 in 2021, a slight recovery in the rig count follows, with 450 rigs at year-end 2021.”

Longer term, the Raymond James strip price scenario is conservative and assumes the domestic count remains flat at 450 rigs.

“When E&P companies were announcing budgets just a month ago with a planning price of $50-55 WTI, the single most consistent commentary from management was that budgets/activity would not increase due to modest increases in crude prices, reflecting a focus on free cash flow generation and returning capital to shareholders,” Molchanov and Freeman wrote. “We believe this assumption holds as much, if not more, at $40-45 WTI.”

The impact of “ultra-depressed” activity this year should hit full force in 2021, with output falling by 1.3 million b/d-plus, according to the Raymond James team. “The fall-off moderates in the out years despite flat activity, as base decline rates become more shallow.”

Societe Generale analysts said long WTI positioning versus short Brent positioning “has translated into expectations of a decreasing Brent-WTI spread, possibly due to the high operational costs and indebtedness of U.S. shale oil companies.

“Some of them may not survive prolonged low oil prices, and in this event U.S. production would decrease. Less crude availability in the US is likely to reduce the WTI discount to Brent.”

North American E&Ps have responded en masse since crude prices plummeted last week.

EOG Resources Inc. has reduced capital expenditures (capex) by 31% to $4.3-4.7 billion; it also is targeting flat year/year crude volume growth. The focus this year is drilling operations in the Permian Basin’s Delaware formation and the Eagle Ford Shale in Texas.

EQT, the nation’s largest natural gas E&P, has lowered its 2020 capex by $75 million to $1.075-1.175 billion. Activity is being reduced, but the decline is not expected to impact 2020 production guidance of 1,450-1,500 Bcfe.

Calgary-based Husky Energy has reduced capex by about 33% or C$900 million to C$2.3-2.5 billion. The cuts are expected to reduce production in 2020 to 275,000-300,000 boe/d from 295,000-310,000 boe/d. “Investment in resource plays and conventional heavy oil projects in Western Canada has been halted,” while drilling pads at all thermal operations have been suspended.

Fellow Calgary E&P Arc Resources Ltd. has cut its spending to C$300 million from $500 million and slashed the monthly dividend to C2 cents from 5 cents. Likewise Calgary E&P Enerplus Corp. has reduced 2020 capex by 40% at the midpoint to C$325 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |