The number of total jobs in Texas’ upstream sector dipped in November after showing positive gains in October and November, driven principally by layoffs in the services sector. The Texas Independent Producers & Royalty Owners Association (TIPRO) reported new government data showing that the sector experienced a decline of 2,300 jobs in November compared to…

Tag / Oil prices

SubscribeOil prices

Articles from Oil prices

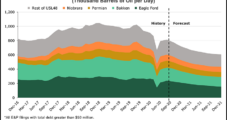

U.S. E&P Bankruptcies Offsetting Lower 48 Growth, with Big Losses Forecast in Oil Output

The voluntary bankruptcies by U.S. exploration operators have continued to mount, with Lower 48 oil production by the insolvent companies set to decrease from current volumes by around 25%, or 200,000 b/d, at the end of 2021, according to a Rystad Energy analysis. “Operated oil production from the recent Chapter 11 filings is heavily weighted…

U.S. Crude Oil Inventory Declines; Weekly Demand Increases But Remains Modest, EIA Says

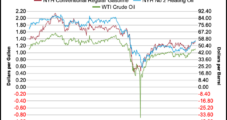

After jumping a week earlier, domestic oil inventories dropped during the week ended Dec. 11, the U.S. Energy Information Administration (EIA) said Wednesday. EIA said in its Weekly Petroleum Status Report that U.S. commercial crude oil inventories — excluding those in the Strategic Petroleum Reserve — decreased by 3.1 million bbl from the prior week.…

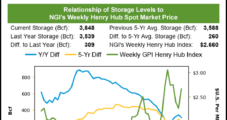

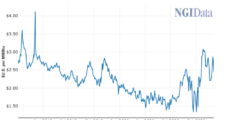

‘Smelling Salts’ Awaken Natural Gas Futures After ‘Quite Strong’ EIA Report; Cash Mixed

Natural gas bulls were on parade Thursday as the stars aligned to offer support for struggling futures prices. Thanks to lower production, a “quite strong” storage withdrawal, cooler-trending weather outlooks and solid export demand, the January Nymex futures contract settled 11.1 cents higher at $2.553. February jumped 11.4 cents to $2.570. Spot gas prices continued…

November Showed More Job Gains for U.S. OFS Sector, but Uncertainty Still Prevails

Oilfield equipment and services jobs in the United States climbed slightly in November for the third month in a row, but it’s still a tough slog with pandemic-related job losses down by nearly 92,000, according to a new analysis. The Petroleum Equipment & Services Association (PESA) said the domestic oilfield services (OFS) and equipment sectors…

Natural Gas Poised for Continued Growth Under Biden, Experts Say

The domestic and global outlook for natural gas remains relatively bright under a Joseph R. Biden Jr. presidency, despite increasingly negative sentiment toward fossil fuels, according to experts. Although the president-elect is calling for a carbon-free power sector by 2030, gas-fired generation is needed to accommodate growing penetration of intermittent wind and solar energy in…

OPEC-Plus Agrees to Slightly Boost Global Oil Output in January

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, on Thursday agreed to boost production beginning in January by 500,000 b/d, ending a multi-day standoff over the timing and volume of an output increase because of concerns that new coronavirus outbreaks could dampen demand into early 2021. The cartel and affiliated countries…

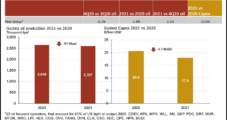

U.S. Onshore D&C Spending Cuts to Far Outpace Oil Output Decline in 2021, Rystad Says

Oil production from U.S. shale plays is likely to hit a floor in 2021 with no further declines expected in a $40 to $45/bbl West Texas Intermediate (WTI) price environment, according to new analysis by Rystad Energy. Output is expected to fall by an estimated 3.1% year/year to 7.5 million b/d in 2020 from 7.7…

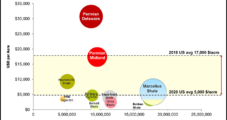

Lower 48 E&P Consolidation Likely to Increase on Lower WTI, Acreage Prices

The average price for U.S. onshore unconventional acreage has declined by more than 70% in the last two years, a precursor to more consolidation through 2022, according to Rystad Energy. The price for Lower 48 acreage fell on average to $5,000/acre this year from $17,000 in 2018, the result of lower West Texas Intermediate (WTI)…

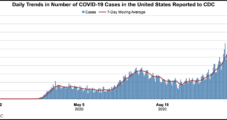

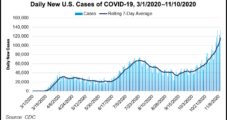

IEA Cuts Outlook for 2020 Global Oil Demand, Sees Fragile Rebound in 2021

The International Energy Agency (IEA) on Thursday lowered its 2020 global oil demand forecast, citing the intensifying effects of the coronavirus pandemic in the United States and Europe. The Paris-based global energy watchdog dropped its 2020 forecast by 400,000 b/d and said it expects a contraction of 8.8 million b/d. IEA estimated global oil demand…