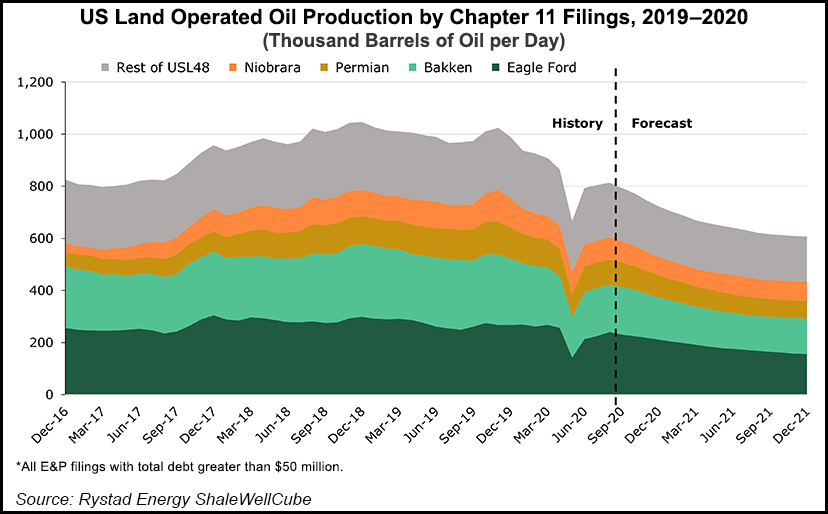

The voluntary bankruptcies by U.S. exploration operators have continued to mount, with Lower 48 oil production by the insolvent companies set to decrease from current volumes by around 25%, or 200,000 b/d, at the end of 2021, according to a Rystad Energy analysis.

“Operated oil production from the recent Chapter 11 filings is heavily weighted in the Eagle Ford and Bakken regions, at almost 400,000 b/d,” analysts said.

Although it’s much bigger, Permian Basin-focused exploration and production (E&P) companies now going through restructuring only produce around 80,000 b/d total, the review found.

An estimated 800,000 b/d of oil production is operated by Lower 48 E&Ps that filed for bankruptcy protection in 2019 and in 2020. With limited capital spending and completion...