Lower 48 E&P Consolidation Likely to Increase on Lower WTI, Acreage Prices

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

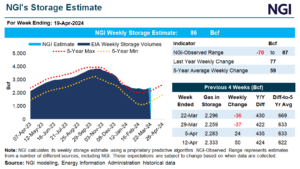

Natural gas futures resumed their climb on Monday, buoyed by a recovery in Gulf Coast LNG feed gas demand above 12 Bcf/d and Lower 48 gas production staying subdued. A jump in Henry Hub cash prices also added support. At A Glance: NGI estimates 86 Bcf injection Freeport restarts LNG exports Production at 98.2 Bcf/d …

April 22, 2024Infrastructure

Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.