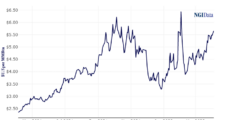

Natural gas futures softened on Friday after surpassing the $6.500/MMBtu mark early in the trading session. With technical pressure amplified given the lack of demand response to the higher price environment, overbought conditions sent the May Nymex futures contract down 8.1 cents to $6.278. June futures fell 8.0 cents to $6.356. At A Glance: Production…

natural gas production

Articles from natural gas production

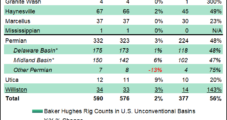

Double-Digit Rig Gains in U.S. Paced by Permian in Latest Baker Count

Led by a surge in rigs flooding into the Permian Basin, the U.S. rig count climbed 16 units to finish the week ended Friday (April 8) at 689, updated figures from Baker Hughes Co. (BKR) show. Oil-directed rigs increased by 13 in the United States for the week, while three natural gas-directed units were also…

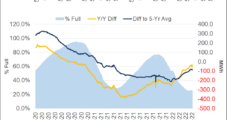

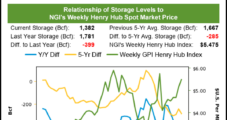

Natural Gas Bulls Regain Momentum After EIA Storage Data; Spot Prices Fall

Despite some hesitation early in Thursday’s trading session, natural gas futures surged higher after the latest government inventory data revealed a dramatic close to the withdrawal season. The May Nymex gas futures contract settled at $6.359/MMBtu, up 33.0 cents from Wednesday’s close. June picked up 32.9 cents to reach $6.436. Spot gas prices fizzled, led…

Natural Gas on Three-Week Bullish Run as U.S. Pipe Imports Stronger – Mexico Spotlight

North American natural gas futures prices barreled through the $6.00/MMBtu ceiling this week as supply worries and soaring global natural gas demand combined to tighten the market. After significant gains on Monday and Tuesday, the May New York Mercantile Exchange futures contract settled at $6.029 on Wednesday, off three-tenths of a cent from Tuesday’s close.…

Is Shift Ahead for North America’s Natural Gas Market? – Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow for a review of supply/demand fundamentals affecting North American natural gas prices today and what they could mean for the market in the near future. In the podcast, NGI’s Patrick Rau, director of Strategy and Research, highlights the potential gas market shift.…

Natural Gas Futures Erase Early Gains, but ‘Bounds on Upside Somewhat Unconstrained’; Cash Higher

After cresting the $6.000/MMBtu mark a day earlier – and then surging to a $6.394 intraday peak – natural gas futures ran out of steam Wednesday. Although there were plenty of factors for bulls to hang their hats on, technical momentum was zapped late in the session. The May Nymex gas futures contract settled at…

U.S. Supply Adequacy Fears Spark Natural Gas Futures Rally

Supply adequacy fears amid continued signs of underwhelming domestic output, amplified by ongoing geopolitical anxieties, helped natural gas bulls confidently rally futures above the psychological $6.00 threshold Tuesday. Cash prices followed futures higher, with the NGI Spot Gas National Avg. advancing 30.5 cents on the day to finish at $5.785/MMBtu. May Nymex futures soared 32.0…

‘No Top’ for Natural Gas Futures as Rally Continues Early; Analysts See Further Upside

After eclipsing the $6.00 threshold, natural gas futures showed no signs of slowing down in early trading Wednesday, advancing further against a backdrop of strong demand and supply adequacy concerns. Coming off a 32.0-cent rally in the previous session, the May Nymex contract was up another 34.5 cents to $6.377/MMBtu at around 8:45 a.m. ET.…

Simmering Supply Fears Spark Natural Gas Futures Rally; Cash Follows Suit

Supply adequacy fears amid continued signs of underwhelming domestic output, amplified by ongoing geopolitical anxieties, helped natural gas bulls confidently rally futures above the psychological $6.00 threshold Tuesday. At A Glance: Early-cycle pipeline nominations show production drop, fueling supply fears Bullish sentiment continues on “same general narrative” Analysis shows E&Ps sticking to maintenance-level spending Cash…

May Natural Gas Sinks, but Upside Risk Remains; Cash Higher as Pipe Work Cuts Flows

Natural gas futures treaded water early Monday as traders looked for fresh direction amid the continued war in Ukraine. After spending much of the afternoon in positive territory, a trio of bearish headwinds eventually left the May Nymex contract nearly unchanged at $5.712/MMBtu. June also barely budged, off two-tenths of a cent to $5.793. Spot…