Natural gas production cuts have stabilized the fuel’s prices by countering weak Lower 48 winter demand, turning the market’s attention to the next big levers for fundamentals: the upcoming summer and added wind and solar capacity.

Prompt-month New York Mercantile Exchange futures, trading above the $1.800 level at the start of April, had settled as low as $1.576/MMBtu in late February before several big natural gas heavies, Chesapeake Energy Corp. and EQT Corp., said they were cutting output.

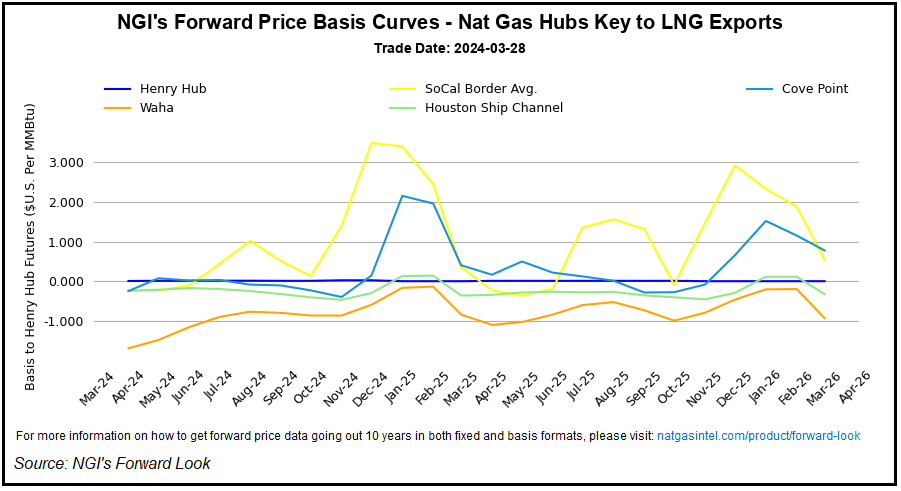

“We saw really big gains, not only at Henry Hub, but at a lot of the pricing locations throughout the United States,” said NGI’s Leticia Gonzales, price and markets editor, at a recent Intercontinental Exchange Inc. (ICE) event in Calgary.

[Want to visualize Henry Hub, Houston...