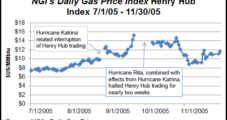

It’s been 12 long, relatively quiet years since Hurricanes Katrina and Rita, which at their highest intensity both ranked as Category 5 storms, washed across the U.S. Gulf of Mexico (GOM) and destroyed natural gas and platforms and onshore infrastructure.

Katrina

Articles from Katrina

Shales Insulating Natural Gas Industry from Hurricane Impacts

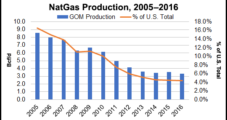

The 2013 Atlantic Hurricane season is deep into its second half and there has yet to be any significant threat to natural gas and oil interests in the Gulf of Mexico (GOM). But with the flood of onshore natural gas that has come out of U.S. shale plays in recent years, would a hurricane in the GOM have the same impact on prices and supply as storms have in the past?

Natural Gas Industry Increasingly Insulated from Hurricane Impacts

The 2013 Atlantic Hurricane season is deep into its second half and there has yet to be any significant threat to natural gas and oil interests in the Gulf of Mexico (GOM). But even if a tropical storm were to blow through the GOM, would it have the same impact on prices and supply as storms have in the past?

Enterprise’s Teague: Ethane Margins to Be Anemic, Volatile

Enterprise Products Partners LP infrastructure bounced back from Hurricane Katrina in 2005 and a fire at Mont Belvieu, TX, in 2011, and the partnership will weather the current “tsunami of natural gas liquids (NGL)” that is ravaging margins in the light end of the NGL barrel, Enterprise COO Jim Teague told financial analysts Thursday.

Enterprise COO: Ethane Margins Anemic, Volatile

Enterprise Products Partners LP infrastructure bounced back from Hurricane Katrina in 2005 and a fire at Mont Belvieu, TX, in 2011, and the partnership will weather the current “tsunami of natural gas liquids (NGL)” that is ravaging margins in the light end of the NGL barrel, Enterprise COO Jim Teague told financial analysts last Thursday.

RRC Notes Texans Had Lowest 2006 Gas Rates in South

While natural gas futures prices recently soared to post-Katrina levels, recent data from the U.S. Department of Energy (DOE) indicates that Texans — during 2006 — had the lowest average residential natural gas rate among most of the southern states, according to Michael L. Williams, chairman of the Texas Railroad Commission (RRC).

RRC Notes Texans Had Lowest 2006 Gas Rates in South

While natural gas futures prices recently soared to post-Katrina levels, recent data from the U.S. Department of Energy (DOE) indicates that Texans — during 2006 — had the lowest average residential natural gas rate among most of the southern states, according to Michael L. Williams, chairman of the Texas Railroad Commission (RRC).

Gas Reserves Rise 6%, Overcoming Losses Due to Hurricane Damage

Despite a 4% drop in natural gas production last year primarily because of Hurricanes Rita and Katrina, U.S. proved natural gas reserves rose about 6% in 2005, the largest annual increase since 1970, the Energy Information Administration (EIA) said in a report Tuesday.

EVA Sees Lower Price Scenario Over Long Term; Key Factor — LNG

Given what happened to the industry last year with Hurricanes Rita and Katrina, it’s pretty easy to make a bull’s case for the natural gas market. In fact many industry prognosticators expect that once the current gas storage surplus is worked off, an underlying tight supply-demand balance will return, driving prices back into the stratosphere. But Stephen Thumb at consulting firm Energy Ventures Analysis in Arlington, VA, believes many experts are underestimating the impact that LNG will have on the U.S. market.

EVA Sees Lower Price Scenario Over Long Term; Key Factor — LNG

Given what happened to the industry last year with Hurricanes Rita and Katrina, it’s pretty easy to make a bull’s case for the natural gas market. In fact many industry prognosticators expect that once the current gas storage surplus is worked off, an underlying tight supply-demand balance will return, driving prices back into the stratosphere. But Stephen Thumb at consulting firm Energy Ventures Analysis in Arlington, VA, believes many experts are underestimating the impact that LNG will have on the U.S. market.