Western Gas Partners LP is expanding its business in the Marcellus Shale after agreeing to pay $620 million-plus for stakes in two natural gas liquids (NGL) gathering systems in Pennsylvania that have combined throughput of more than 1.2 Bcf/d.

Julesburg

Articles from Julesburg

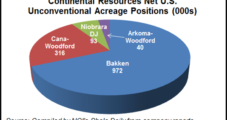

Bakken-Fueled Continental Aiming to Triple Output, Reserves

Continental Resources Inc. has launched a growth plan to triple production and proved reserves between now and the end of 2017, largely from its leading Bakken Shale position, but also with gains from other onshore holdings, including a discovery in the southwest corner of Oklahoma.

Eagle Ford Production Booming with Focus on Oil

Crude oil production from the Eagle Ford Shale of South Texas has overtaken gas production, which is increasing the shale’s profitability, a recent analysis of the play has found.

Chesapeake Leading Early Gold Rush in Niobrara Shale

Permits and production are soaring in the Niobrara Shale where Chesapeake Energy is indicating it has unlocked some important finds as it eyes the play as a significant contributor to its strategy for expanding its production of natural gas liquids (NGL).

Industry Brief

Oklahoma City-based GMX Resources Inc. has hired Global Hunter Securities to help it sell a portion of the company’s Cotton Valley Sand liquids-rich natural gas properties in East Texas. A transaction is expected during the third quarter, GMX said. The company’s natural gas resources are in the East Texas Basin, in the Haynesville/Bossier shale and the Cotton Valley Sand Formation, where the majority of its acreage is contiguous, with infrastructure in place and substantially all held by production, GMX said. In early 2011 GMX branched out from its Haynesville/Bossier properties and acquired about 67,724 net acres within the core horizontal oil development areas of the Bakken/Sanish-Three Forks Formation in the Williston Basin and the Niobrara Formation in the Denver-Julesburg Basin (see Shale Daily, Feb. 2, 2011).

Moody’s: Chesapeake Must Sell $7B of Assets or Breach 2012 Debt Covenants

Chesapeake Energy Corp. has to sell “at least” $7 billion worth of assets this year to avoid a breach of debt covenants and a credit downgrade, a senior analyst with Moody’s Investors Service said Thursday.

Chesapeake Markets DJ Basin Properties

A package of five conventional and unconventional properties in the northern Denver-Julesburg (DJ) Basin of Wyoming and Colorado is up for sale by Chesapeake Energy Corp. Gross acreage is estimated at more than 684,000 acres; net acreage totals about 504,000 acres, according to Meager Energy Advisors, the listing agent.

Trio’s NGL Pipe to Tie DJ Basin to Gulf Coast Market

Enterprise Products Partners LP, Anadarko Petroleum Corp. and DCP Midstream LLC plan to construct a natural gas liquids (NGL) pipeline from the Denver-Julesburg (DJ) Basin in Weld County, CO, to Skellytown, TX, in Carson County. Initial capacity of the y-grade Front Range Pipeline is expected to be 150,000 b/d.

Trio Plans NGL Pipeline From DJ Basin to Gulf Coast

Enterprise Products Partners LP, Anadarko Petroleum Corp. and DCP Midstream LLC plan to construct a natural gas liquids (NGL) pipeline from the Denver-Julesburg (DJ) Basin in Weld County, CO, to Skellytown, TX, in Carson County. Initial capacity of the Front Range Pipeline is expected to be 150,000 b/d.

New NGL Pipeline Would Tie DJ Basin to Gulf Coast Market

Enterprise Products Partners LP, Anadarko Petroleum Corp. and DCP Midstream LLC plan to construct a natural gas liquids (NGL) pipeline from the Denver-Julesburg (DJ) Basin in Weld County, CO, to Skellytown, TX, in Carson County. Initial capacity of the Front Range Pipeline is expected to be 150,000 b/d.