NGI Archives | NGI All News Access

Eagle Ford Production Booming with Focus on Oil

Crude oil production from the Eagle Ford Shale of South Texas has overtaken gas production, which is increasing the shale’s profitability, a recent analysis of the play has found.

“Eagle Ford production showed a three-fold increase in overall production in 2011 over 2010 levels, thanks to an increase in crude oil prices over natural gas prices,” said UK-based Companies and Markets. “Texas has seen the Eagle Ford Shale churn out four times as much liquids in 2011 as compared to 2010, with production growing from 10.8 MMboe to 57.5 MMboe, and the profitability associated with the crude oil prices is supporting this trend.”

According to the Railroad Commission of Texas, the Briscoe Ranch field reported the highest gross production of around 26.2MMboe from the Eagle Ford shale during 2011, the firm said.

“A total of 4,286 drilling permits were issued in the play throughout 2011, while the first four months of 2012 have seen 1,620 drilling permits distributed already, and GlobalData anticipates that the Eagle Ford Shale play will continue to see increased drilling activity during the coming years,” Companies and Markets said.

Total gross production from the Eagle Ford shale increased from 0.02 MMboe in 2006 to 105 MMboe in 2011 at a compound annual growth rate of 435%, and it is expected to reach 207.3 MMboe in 2012, and stabilize at 1,386.3 MMboe in 2020.

Companies leading the Eagle Ford charge include Anadarko Petroleum Corp., Petrohawk Energy Corp., EOG Resources Inc., Burlington Resources Inc. and Rosetta Resources Inc.

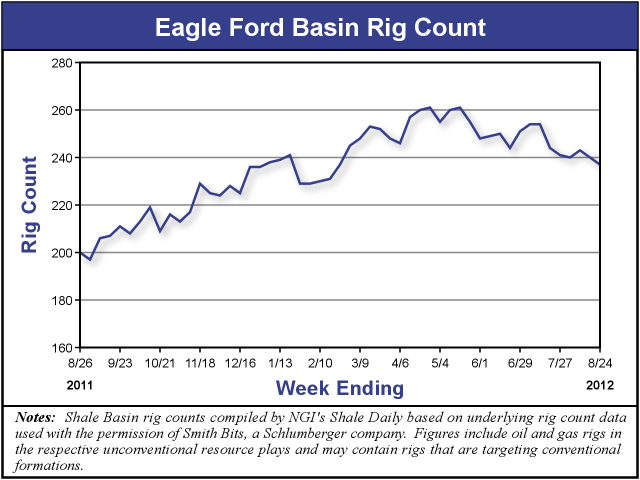

Thanks to a natural gas production surplus that pushed dry gas prices to 10-year lows earlier this summer, exploration and production focus has turned from natural gas to more liquids-rich targets. Of the 13 unconventional plays tracked in NGI‘s Shale Daily Unconventional Rig Count, the Eagle Ford Shale is only one of three plays showing an increase in drilling activity over a year ago.

The rig count shows that the Eagle Ford Shale had 237 rigs in operation for the week ending Aug. 24, which is down three rigs from the previous week, but up 19% from the 200 rigs in operation for the similar week one year ago.

Like the Eagle Ford, the other two production targets that are showing an increase in drilling over year ago levels — the Bakken/Sanish/Three Forks play and the Niobrara-Denver Julesburg Basin — are also considered to be liquids-rich.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |