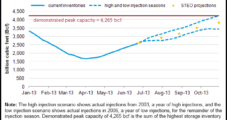

A reclassification of “base” gas to “working” and a cooler-than-expected August make for an end-of-injection season storage forecast that is 20 Bcf higher than the one issued last month in the Energy Information Administration’s (EIA) Short Term Energy Outlook (STEO), the agency said Tuesday.

Tag / Inventories

SubscribeInventories

Articles from Inventories

EIA Expects Storage to Exit October More Than 100 Bcf Shy of 2012

The Energy Information Administration (EIA) reported Thursday morning that while end-of-refill-season working natural gas storage levels are expected to be ample, inventories could enter November at the lowest level in three years.

Moody’s Lifts NatGas Price Assumption on Declining Inventories

Lower-than-expected natural gas inventories have led Moody’s Investors Service to lift its assumptions for North American Henry Hub natural gas spot prices by 50 cents to $3.50/MMBtu in 2013 and $4.00/MMBtu in 2014 and thereafter.

Industry Briefs

Lower-than-expected natural gas inventories led Moody’s Investors Service to lift its assumptions for North American Henry Hub natural gas spot prices by 50 cents to $3.50/MMBtu in 2013 and $4.00/MMBtu in 2014 and thereafter. Prices sagged in recent years on the unconventional drilling boom and mild weather, which has led to an oversupply, but prices have climbed in 2012 on coal-to-gas switching in the power generation sector and hot weather, and as companies have scaled back their dry gas drilling, Moody’s said. Assumptions for natural gas liquids prices remain unchanged at $34/bbl in 2013, 2014 and thereafter, pegging prices at 40% of West Texas Intermediate prices.

EIA: August Shale Production Not Enough to Counter Overall Decline

New wells in the nation’s shale plays helped push natural gas production higher in Texas and some other states in August, but it wasn’t enough to keep the U.S. total from sliding to 76.60 Bcf/d, a 3.4% decline compared with 79.33 Bcf/d in July, according to the Energy Information Administration’s (EIA) latest Monthly Natural Gas Gross Production report.

Industry Brief

Marathon Petroleum Corp. agreed to pay $598 million plus inventories estimated at $1.2 billion for BP plc’s 451,000 b/d Texas City, TX, refinery, three instrastate natural gas liquids pipelines originating at the refinery, an allocation of BP’s Colonial Pipeline Co. shipper history, four terminals, retail marketing contract assignments for about 1,200 branded sites and a 1,040 MW cogeneration facility. The agreement contains an earnout provision under which Marathon could pay up to an additional $700 million over six years, subject to certain conditions. The acquisition is expected to be funded with cash on hand and is anticipated to close early in 2013. The deal continues BP’s plan to sell assets to shore up its share price and help fund a $20 billion trust fund set up following the April 2010 Macondo well blowout in the Gulf of Mexico (GOM) (see Daily GPI, Oct. 26, 2011). Last month Plains Exploration & Production Co. said it would pay BP $5.55 billion for deepwater GOM oil and gas properties (see Daily GPI, Sept. 11).

Futures Short-Covering Prompts Broad Cash Rally

The physical market bounded sharply higher Tuesday, prompted by a strong screen and low inventories at some points. Nearly all points recorded double-digit gains. At the close of futures trading, October had added 18.0 cents to $2.992 and November had climbed 16.3 cents to $3.104. October crude oil gained 63 cents to $97.17/bbl.

FERC Report: Shales Boost Production, Lower Prices

Continuing high natural gas production levels driving prices to the sub-$2 level raise concerns of an eventual production bust that could result in higher prices for producers, according to a market report Thursday by FERC’s Office of Enforcement (OE).

Little Chance Seen of Reversing Widespread Drops

Virtually all points fell Thursday as they succumbed to a triple whammy of bearish threats: further increases in storage inventories, futures weakness and mild weather for mid-winter that refuses to go away and allow normal cold conditions to take hold.

Ever Growing Supply Surplus Weighs on Futures; January Dips

January natural gas continued its march towards $3 as recent weather forecasts hint of milder conditions and a subsequent low withdrawal from storage inventories. At the close January had retreated 3.1 cents to $3.096 and February gave up 3.1 cents t $3.143. January crude oil gained 35 cents to $93.88/bbl.