As the relentless march higher for natural gas prices finally began to show signs of slowing down, forwards prices recorded discounts throughout the Lower 48 during the April 14-20 trading period, NGI’s Forward Look data show. Fixed prices for May delivery at benchmark Henry Hub eased 6.0 cents lower to end the period a hair…

Tag / Inventories

SubscribeInventories

Articles from Inventories

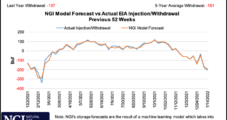

EIA Delivers Bearish 53 Bcf Storage Build, Sending Natural Gas Prices Lower

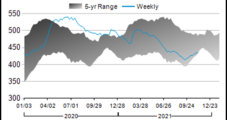

The Energy Information Administration (EIA) said storage inventories for the week ending April 15 rose by 53 Bcf, a huge miss to the upside that sent natural gas prices tumbling. The May Nymex gas futures contract was trading a few cents higher day/day at around $6.980/MMBtu in the minutes leading up to the EIA report.…

May Natural Gas Futures Extend Rally Following Bullish Storage Injection

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 15 Bcf natural gas into storage for the week ended April 8. The result was roughly in line with expectations and bullish when compared with historic norms. Nymex natural gas futures surged in response. Ahead of the EIA report, the May futures contract…

Markets Shrug Off Bearish Inventory Print, Send April Natural Gas Futures Higher

U.S. utilities withdrew 51 Bcf natural gas from storage for the week ended March 18, the Energy Information Administration (EIA) reported Thursday. The result fell short of market expectations for a pull in the high 50s Bcf, but futures forged ahead regardless. Ahead of the EIA print, the April futures contract was down 7.3 cents…

Natural Gas Futures Surge as European Weather Model Shows Winter Chill Lingering Longer; Cash Rallies

Natural gas futures staged a stunning recovery Monday as one of the major weather models added a huge chunk of demand to the late-February forecast. The March Nymex gas futures contract settled on the higher end of its trading range at $4.195/MMBtu, up 25.4 cents from Friday’s close. April jumped 22.5 cents to $4.160. Spot…

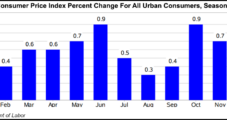

Accelerating Inflation Presents Natural Gas, Oil Companies Potential for Profits and Pitfalls

Soaring energy prices – driven most recently by spikes in crude – helped drive the U.S. inflation rate to a 40-year high in January, creating both opportunity and risk for oil and natural gas companies. The U.S. Bureau of Labor Statistics (BLS) said Thursday the consumer price index (CPI) jumped 7.5% in January from the…

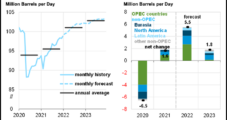

U.S. Crude Inventories Dive Lower as Demand Outstrips Production, Imports

Domestic petroleum consumption climbed in early February, driven by robust demand for gasoline, while production only crept ahead and inventories dropped to a 2022 low. Demand rose 2% week/week to 21.9 million b/d during the period ended Feb. 4, according to the U.S. Energy Information Administration (EIA). The advance was driven by an 11% jump…

Expected February Warm-Up Limits Price Gains for Nymex Natural Gas Futures; Cash Surges

Natural gas futures were sluggish to start the week as weather models came into agreement in showing a lack of continued frigid weather into early February. Though production remains off recent highs and export demand continues to be near record levels, the February Nymex gas futures contract on Monday settled at $4.027/MMBtu, up only 2.8…

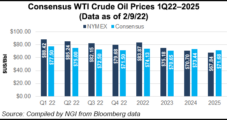

As Global Demand Climbs, Is $100 Oil High Enough?

With demand rising in the United States and forecasts calling for robust increases in crude consumption globally through 2022, more analysts are betting that oil prices this year could exceed $100/bbl. Bank of America (BofA) and Morgan Stanley analysts both said they expect Brent crude, the international benchmark, to reach triple digits in 2022, as…

U.S. Crude Inventories Rise Again Alongside Production; Travel Fuel Demand Declines

Domestic oil stocks increased for a third straight week as producers held output at elevated levels – at least by 2021 standards — while high prices curbed gasoline and jet fuel demand. The U.S. Energy Information Administration (EIA) said Wednesday crude inventories for the week ended Nov. 5, excluding those in the Strategic Petroleum Reserve…