Gulfport Energy Corp. expects to increase the number operated horizontal rig count in the Utica Shale to seven from the current four by the end of June, and it has budgeted $494-504 million to drill 55-60 gross (49-54 net) wells in the play this year, company officials said Wednesday.

Interest

Articles from Interest

Kinder Expanding Project for Eagle Ford Crude

Kinder Morgan Energy Partners LP (KMP) and BP North America have struck a long-term, fee-based agreement supporting an additional 50,000 b/d of throughput capacity at a condensate processing facility KMP is constructing on the Houston Ship Channel.

Australia’s Aurora Buys More Eagle Ford Acreage

Aurora Oil & Gas Ltd. is buying a 100% operated working interest in 2,700 net acres in South Texas in the liquids-rich area of the Eagle Ford Shale for $117.5 million.

Cline Shale Spurs Pipeline Capacity Restart

As producers’ interest in the Permian Basin’s Cline Shale oil play continues to grow, Occidental Petroleum Corp. unit Centurion Pipeline LP is reactivating and expanding an existing pipeline system overlying the Cline, the company said.

Plan In Hand, Newfield Needs to Execute, Analyst Says

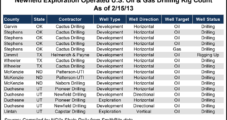

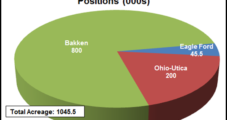

Shares of Newfield Exploration Co. (NFX) have taken a beating since the company last week provided its outlook for liquids production growth and announced plans to jettison international assets in favor of U.S. plays. It’s a sign that investors have heard enough talk and are ready to see action.

Hess to Spend 40% of E&P Budget on U.S. Shale Prospects

Hess Corp. said Wednesday it plans to spend $6.8 billion on capital expenditures (capex) in 2013, with the largest share — $2.7 billion, or 40% of the exploration and production (E&P) budget of $6.7 billion — devoted to unconventional resources.

Industry Brief

Dow Chemical Co. began producing on-spec ethylene in late December at its St. Charles Olefins 2 Plant near Hahnville, LA, the company said. “The start-up of our St. Charles ethylene plant represents the first major milestone within our U.S. Gulf Coast investment strategy,” said Brian Ames, president, of Dow’s olefins, aromatics and alternatives business. “This action further reduces the company’s purchased ethylene, lowering costs and strengthening the competitiveness of our high-margin, high-growth derivatives businesses.” Restart of the plant had been previously announced and is part of the company’s plan to further connect its U.S. operations with cost-advantaged feedstocks from U.S. shale gas (see Shale Daily, Dec. 13, 2012). “Plans to increase ethylene and propylene supply and ethane cracking capabilities at existing U.S. Gulf Coast facilities strengthen the competitiveness of Dow’s performance plastics, performance products and advanced materials businesses and enable profitable growth in the Americas,” the company said. The St. Charles plant was idled in January 2009 and is now expected to deliver a $150 million increase in earnings before interest, taxes, depreciation and amortization this year.

LNG Exports Depend Upon Shale Gas Staying Power, Study Finds

Exporting liquefied domestic natural gas to world markets would generate a net benefit to the U.S. economy, and the more liquefied natural gas (LNG) that’s exported, the greater the benefit, according to a macroeconomic analysis of the impact of LNG exports commissioned by the U.S. Department of Energy (DOE) and released for public comment Wednesday.

Big Sky Gains Entry into Texas Wolfcamp/Wolfberry

Big Sky Petroleum Corp. has acquired a 90% working interest in an initial lease block of more than 2,300 net operated acres on the eastern shelf of the southern Midland Basin in West Texas. The deal gives the Vancouver, BC-based company entry into the Wolfcamp/Wolfberry play.

Rara Terra Acquires Interest in Oil, Gas Leases in Kansas

Rara Terra Minerals Corp. has reportedly acquired a 75% working interest in oil and natural gas leases in Trego County, KS, for $393,750.