Spectra Energy Corp. is taking a one-third interest in the Sand Hills and Southern Hills pipelines, both of which are under construction by DCP Midstream LLC, a joint venture of Spectra and Phillips 66. The deal is expected to close by the end of November when Spectra, Phillips 66 and DCP Midstream each would own one-third of the pipelines and equally fund their completion. The aggregate investment by Spectra is expected to be $700-800 million. Sand Hills, which would take natural gas liquids from the Permian Basin and Eagle Ford Shale to Gulf Coast markets, would have an initial capacity of 200,000 b/d and be expandable to 350,000 b/d. The first phase recently came online and connection to Mont Belvieu, TX, is expected by year-end (see Shale Daily, Oct. 29). The timing of Sand Hills’ second phase, the Permian portion of the pipeline, has advanced and is due to be in service in 2Q2013. Southern Hills would provide 150,000 b/d, expandable to 175,000 b/d, of capacity from the Midcontinent to Mont Belvieu and has a targeted in-service date of mid-2013.

Interest

Articles from Interest

Sanchez More Than Triples Year-Ago Production

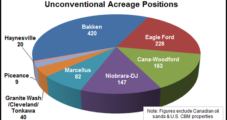

Houston-based independent Sanchez Energy Corp. grew its production by more than 350% from a year ago as of the end of the third quarter, said the company, which has a 95,000 net acre position targeting the liquids-rich Eagle Ford Shale, Pearsall Shale, Austin Chalk and Buda Limestone.

Industry Brief

Spectra Energy Partners LP is acquiring a 38.76% interest in Maritimes & Northeast Pipeline LLC (M&N) from Spectra Energy Corp. for $319 million in cash and $56 million in newly issued partnership units. M&N owns a 338-mile mainline interstate natural gas pipeline that extends from the border of Canada near Baileyville, ME, to northeastern Massachusetts with delivery capability of 0.8 Bcf/d. The pipeline’s location and interconnects with Spectra’s transmission system link regional natural gas supplies to the Northeast United States and Atlantic Canadian markets. M&N cash flows are backed by an average contract life of approximately 19 years and more than 90% fee-based revenues. The deal is being be through a combination of debt and equity; closing is set for the end of October.

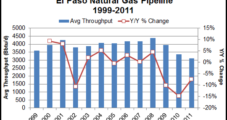

Kinder ‘Thinking About’ Moving Permian Oil West on El Paso

With oil production booming in the Permian Basin of West Texas, projects are being developed to serve producers wanting to get their oil to Houston. But going west on a converted portion of Kinder Morgan’s El Paso Natural Gas (EPNG) system could one day be an option, too.

Marathon Letting Go of Non-Core Eagle Ford Acreage

Marathon Oil Corp. is selling all of its interest in 98,409 gross acres (96,738 net) in nine tracts in Karnes, Northern Bee and Wilson counties, TX, in the Eagle Ford Shale. However, the play remains a core focus of the company.

Fitch: Eagle Ford Spending Easier on Midstream Credits

Liquids-rich gas and high initial production rates from oil wells are driving red hot interest in the Eagle Ford Shale, and this is only bolstered by the region’s established midstream infrastructure and proximity to energy markets, Fitch Ratings said in a new report. More isolated shale basins need costly “mega pipelines,” which are tougher on credit ratings, Fitch said.

Gas Natural’s Maine Pipeline Plan Moves Forward

Gas Natural Inc. has closed on its acquisition of a leasehold interest in a 189-mile pipeline corridor easement in Maine that runs from Searsport to Limestone and various parcels of land, the Mentor, OH-based holding company said Friday. The $4.5 million deal, which included $2.25 million in cash and 210,951 shares of the company’s common stock valued at $10.67/share, closed Sept. 25.

Gasland Director Gets a Note from Energy Industry

In the film industry, directors give notes to actors about how to improve their performances. The energy industry has turned the tables on Gasland director Josh Fox, giving him some pointers for the sequel to his anti-hydraulic fracturing (fracking) film.

Flaring-to-Fertilizer Could Be North Dakota Fix

Facing an ongoing challenge of flaring up to almost a third of its associated natural gas supplies in the oil-rich Bakken Shale, North Dakota is considering a proposal to use mobile equipment to turn some of the flared supplies into much-needed fertilizer for the state’s agricultural industry. Another proposal calls for a $1 billion farmer-owned fertilizer plant using natural gas currently being flared.

Magnum Hunter to Test Potential of Pearsall Shale

Magnum Hunter Resources Corp. Wednesday said it plans to test for the first time the potential of the deep Pearsall Shale formation in South Texas after agreeing to pay $2.35 million to buy an additional 1,885 net mineral acres in Atascosa County.