Natural gas scheduled for delivery Wednesday rose 2 cents on average in Tuesday’s trading, but the nominal rise masked greater market strength. If volatile points in the Northeast showing multi-dollar declines are subtracted from the figures, the overall gain comes in at 8 cents.

henry hub

Articles from henry hub

Texas Freeze Slams Pioneer; Another Wintry Blast On Its Way

A sustained blast of icy weather across Texas last week put a halt to exploration and production (E&P) activity in the Permian Basin, Barnett and Eagle Ford shales, with Pioneer Natural Resources Co. indicating it could be weeks before the full impact is determined.

December Bidweek Traders Riding Full Storage Into the Cold

December bidweek prices showed hefty double-digit gains throughout the country, with NGI’s National Average for the month jumping 24 cents from November to $3.77. Only a single individual point, PG&E Citygate, posted a loss, and advances of double-digits and in some cases, multi-dollars, were registered.

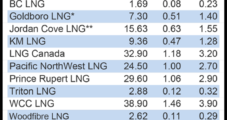

Aurora Enters Canada’s 165 Tcf LNG Export Race

A jumbo Chinese project has raised the volume of supplies earmarked for liquefied natural gas (LNG) exports from proposed Canadian terminals to 165.4 Tcf.

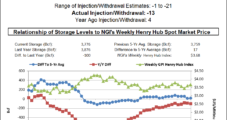

Cold, Demand to Remind Market of Storage Value, Developer Says

Gas price volatility has declined and forward spreads have contracted. With plenty of shale gas around, “who needs gas storage capacity?” is a question on the lips of some. But with the heart of winter fast approaching, attitudes could change, a storage developer told NGI.

Rockies, Midwest Firm Ahead Of Cold; Futures Add 3 Cents

Natural gas for delivery Tuesday added 6 cents on average in Monday’s trading, with Midwest points up a couple of pennies as a major influx of cold air was forecast to slide into the area by midweek. At the close January natural gas futures had gained 3.4 cents to $3.988 and February had risen 2.7 cents to $3.984. January crude oil gained $1.10 to $93.82/bbl.

Plump Gains Characterize Short Trading Week

The NGI weekly spot gas average posted a stellar overall 24 cent gain to $3.93 for trading Nov. 25 and Nov. 26. All locations posted double-digit gains with the exception of three points on Iroquois Pipeline, which each shed less than a dime. Regionally the Northeast was a land of extremes tallying the week’s biggest winners and losers. Of the actively traded points Algonquin Citygates made it to the top adding 88 cents to $7.84 and deliveries to Iroquois Zone 2 eased 9 cents to $4.58. Regionally the Northeast outdistanced all section of the country with a 34 cent rise. California trailed the pack with “only” an 18 cent gain.

White House Report: Interior to Target ‘Antiquated’ Fracking Regs in 2014

In a report released Tuesday on the Obama administration’s regulatory priorities for the upcoming year, the Interior Department cited revising “antiquated” hydraulic fracturing (fracking) regulations as one of its top priorities, as well as new draft rules to regulate venting and flaring on federal and Indian lands, and the valuation of royalties for oil shale development.

Industry Briefs

Silverback Exploration LLC, a newly formed oil and gas exploration company, has received a $350 million equity commitment fromEnCap Investments. San Antonio-based Silverback will use the capital to pursue and develop unconventional resource play opportunities in the United States. Silverback is led by CEO George M. Young Jr., who most recently served as president of Collins and Young LLC.

Physical, Futures Chart Different Courses; January Adds 3 Cents

Physical natural gas for Sunday and Monday delivery tumbled nearly 20 cents in Wednesday’s trading, yet if Boston, New York and Philadelphia are excluded from the analysis, the decline comes in at a more moderate 11 cents.