NGI Data | NGI All News Access

December Bidweek Traders Riding Full Storage Into the Cold

December bidweek prices showed hefty double-digit gains throughout the country, with NGI‘s National Average for the month jumping 24 cents from November to $3.77. Only a single individual point, PG&E Citygate, posted a loss, and advances of double-digits and in some cases, multi-dollars, were registered.

The increases by both Algonquin Citygate ($9.68 to average $14.80) and Tennessee Zone 6 200 L ($8.29 to average $13.37) led the charge higher and pushed the Northeast to the strongest regional gain of 35 cents to average $3.80. PG&E Citygate was off 4 cents to $3.94 and was the only actively traded location in the loss column. Regionally, California points rose 13 cents to $3.89.

Even with the onset of winter, the Midcontinent rose 10 cents to $3.57 and represented the lowest cost December bidweek region. The Rocky Mountains added 11 cents to $3.70.

Both East Texas and the Midwest made bidweek gains of 21 cents to $3.69 and $3.93, respectively, while South Texas gained 28 cents to $3.70 and South Louisiana rose 29 cents to $3.76.

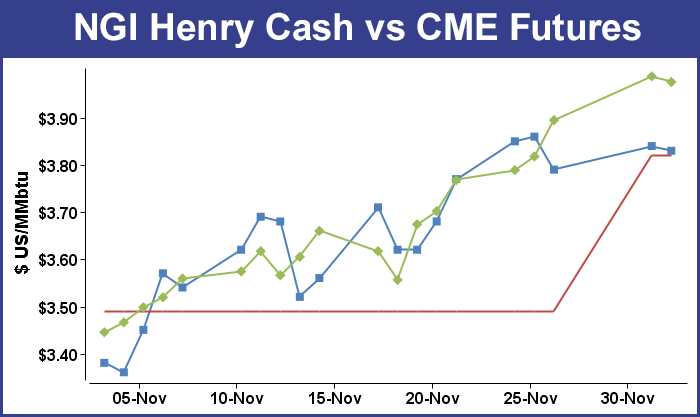

December futures expired at $3.818 on Tuesday, up 32.1 cents from the late October expiration of the November futures at $3.497. For the five days of bidweek, January futures rose 15.5 cents to $3.895.

In spite of forecasts for pervasive cold, bidweek traders were not inclined to take aggressive long positions. “I’ve heard that people have their storage topped off and are not making large bidweek commitments,” said a Houston-based trader working the Chicago Citygate market. “They have plenty of storage to pull out, and we’ll see about weather developments.” Weather is always an uncertainty, and “if you go in, you are committing that the weather is going to develop, and weather has been pretty freaky right now.

“One day the forecast was for cold and the next day it is for 20 degrees above normal, so the weather forecasts haven’t been the best or consistent. That’s where the value comes in. Volatility is good,” the marketer said.

A Michigan buyer agreed that the current storage situation would have him going lighter on his company’s bidweek purchases. “We probably won’t go as heavy on bidweek volumes. We haven’t done any November withdrawals [for customers] thinking it could get worse. Our customers are pretty full.”

A Rocky Mountain producer was inclined to lean more heavily to December spot market purchases. “We might just say to heck with it and ride the market.” The producer admitted that much of the company’s longer term production was hedged. “We’ve got 60% of next year’s production locked in at $4.05, and we are wondering if we should lock in a little more.”

As bidweek drew to a close Wednesday, traders were treated to a surprise in the form of the market’s reaction to the weekly Energy Information Administration (EIA) storage report. The EIA reported a withdrawal of 13 Bcf for the week ending Nov. 22, about what traders were expecting, but prices advanced nonetheless. At the close of trading Wednesday January had risen 3.1 cents to $3.895.

“I don’t know why the market rallied off the number. It was -13 and the market was looking for -12,” said a New York floor trader. “A difference of 1 Bcf makes the market move?” he asked. “It wasn’t really a bullish number.”

Tim Evans of Citi Futures Perspective viewed the report as “constructive” and “a larger draw than it might have been and no offset to the larger net withdrawals anticipated for the weeks ahead as colder temperatures boost heating demand.”

While coming in smaller than the five-year average withdrawal of 15 Bcf, the actual 13 Bcf decline was much larger than last year’s date-adjusted 2 Bcf withdrawal.

Inventories now stand at 3,776 Bcf and are 100 Bcf less than last year and 17 Bcf above the five-year average. In the East Region 14 Bcf was withdrawn, and in the West Region 6 Bcf was pulled. Inventories in the Producing Region rose by 7 Bcf.

Recent gains notwithstanding, futures traders Wednesday were not convinced that the market could hold $4.00. “As long as this dynamic of year-over-year deficit contraction continues, a significant or sustainable price selloff could prove elusive,” said Jim Ritterbusch of Ritterbusch and Associates. “Nonetheless, we see the market beginning to approach the red zone on the upside as we are having difficulty constructing a sustainable $4 pricing environment within the newly prompt January contract.”

In Wednesday’s physical trading, natural gas for Sunday and Monday delivery tumbled nearly 20 cents, yet if Boston, New York and Philadelphia are excluded from the analysis, the decline comes in at a more moderate 11 cents. Traders had to look beyond the Thanksgiving holiday to the Sunday-Monday period and that uncertainty, plus full storage and temperatures expected to be close to seasonal averages, ended up being enough to restrain buyers. New England posted losses at or above $3.00 and the Mid-Atlantic was down by solid double digits. Declines in the Midwest were more tempered and ranged anywhere from a few pennies to a dime or more.

Quotes at Northeast locations had the trajectory of a safe falling from a 10-story building as temperatures were forecast to reach close to normal levels. New England power requirements were expected to fall then rise by the start of December. New England ISO forecast last Wednesday that Wednesday’s peak load of 17,450 MW would fall to 16,990 MW by Sunday and jump to 18,140 MW Monday.

Traders moving gas into the Chicago area reported normal operations following a recent series of storms earlier in the week. “I didn’t have any trouble with my gas,” said a Houston-based trader. “With it being 32 degrees in Texas there could be freeze-offs, but I haven’t heard of anything. In the Chicago area they are used to that sort of thing, but there could be load loss from damaged power lines. That doesn’t appear to be material.”

Longer term weather forecasts called for cold. Commodity Weather Group (CWG) in its six- to 10-day outlook said “Cold weather dropping into the Midwest [last Wednesday] is coming in a bit stronger than expected with Chicago dropping into the lower teens.” Forecasters expected “moderating temperatures” to return last weekend in the Midwest, South, and East “as the next round of powerful Arctic air starts to drop into Western Canada.”

“That air mass is forecast to hit more of the West first, and we had to adjust temperatures colder again, especially the Pacific Northwest, where record cold appears to be aiming. Otherwise, the shift to the Midcontinent appears to be on schedule for late in the six-10 into the 11-15 day. There are still big questions as to how much (and how fast) cold makes it to the East Coast, but at least for now, it seems like it will be more of a diluted version compared to Midwest, Texas, and West cold,” said CWG President Matt Rogers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |