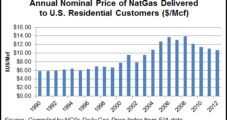

Government agency said it also expects Americans to spend more this winter to heat their homes with natural gas.

Heating

Articles from Heating

AGA: Customers to Pay 5-10% More on Winter Gas Bills

Natural gas will remain the most affordable heating option for most residential customers this winter, with mild temperatures expected to keep any increase in gas bills at no more than 5-10% compared with last winter, according to the American Gas Association (AGA).

Montana Lawmakers Eye Oil/Gas Impacts

With exploration and production (E&P) activity heating up along the eastern border of Montana as an extension of the North Dakota oil and natural gas boom, state lawmakers in the Big Sky state have proposed about a half-dozen new laws to deal with the impact on the local communities in the region.

Competition for Drilling Water Leading to Innovations

As drillers compete for access to water for their operations, researchers are looking for new ways to reuse and recycle wastewater for the good of the environment, as well as looking ahead to the possibility of more restrictions at the state or federal level that may be imposed on underground injection wells, according to Accenture.

Industry Briefs

The University of Massachusetts is switching the Central Heating Plant at its Amherst campus from oil to a liquefied natural gas system, a project that could provide $2 million of fuel cost savings annually, according to the university’s five-year capital plan. The $1.2 million project, which is going into operations this month, will allow the plant to end its practice of burning oil when winter conditions cause gas curtailments, according to The Massachusetts Daily Collegian. The plant will rely primarily on natural gas from Tennessee Gas Pipeline’s Northampton Lateral.

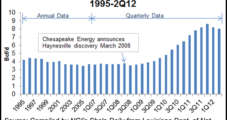

Haynesville, Barnett Natural Gas Output Exceeds Analyst Estimates

U.S. natural gas prices may well go higher over the next 18 months to two years, but a few things could stand in their way, including stronger-than-forecast dry gas output from unconventional plays, including the Haynesville and Barnett shales, Credit Suisse analysts said Wednesday.

Industry Briefs

The Eagle Ford Shale will drive a 15% increase in onshore gas production from the Texas Gulf Coast by November, offsetting declines elsewhere in Texas, according to Bentek Energy LLC. The firm said it expects Texas to be “increasingly long gas in the near term as Eagle Ford production growth continues to outpace demand,” putting downward pressure on regional prices. According to Bentek’s Texas Observer, the state’s supply is up by 1 Bcf/d, or 5%, from a year ago, with the increase driven by growth in onshore production. Demand is up only 0.6 Bcf/d over the same period, according to Bentek. “Due to the combination of Marcellus [Shale] pushback and milder winter weather, net Texas outflows have declined nearly 0.4 Bcf/d since this time last year. As a result, Texas is currently 0.8 Bcf/d longer supply than year-to-date 2011,” Bentek said.

Winter Ends on Warm Note: March 2012 Warmest Since 1950

Last month was the warmest March since 1950 based on natural gas-weighted heating degree days (GWHDD), with decades-old temperature records falling in cities across the United States, weather analysts said Monday.

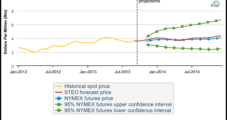

Most Cash Points Firm; Futures Traders Ponder Market Bottom

Cash prices on Friday rose throughout the country except for in the Northeast following Thursday’s strength in futures, but the March contract eased as the market couldn’t shake the stranglehold of moderate weather and plump storage.

Few Points Able to Avoid General Price Slide

With most areas returning to seasonal or warmer-than-normal temperatures, the decline in heating load was sufficient to cause lower prices at all but three points Thursday. The relatively rare substantive gain of 10.3 cents by February futures a day earlier obviously had little impact in stanching the continued bleeding of cash prices.