EOG Resources Inc. has unveiled a 21 Tcf net natural gas resource in a familiar play in South Texas, which holds an estimated 1,250 net locations in the Austin Chalk and Eagle Ford Shale formations. The discovery on the Dorado prospect is in Webb County, where EOG has 163,000 net acres, in 700 feet of…

Earnings

Articles from Earnings

EOG’s 21 Tcf Natural Gas Discovery in South Texas Competitive with ‘Premium Oil Plays,’ Says CEO

Super independent EOG Resources Inc. has identified 21 Tcf net natural gas resource potential with an estimated 1,250 net locations in the South Texas formations of the Austin Chalk and Eagle Ford Shale. The discovery on the Dorado prospect is in Webb County, where EOG has 163,000 net acres, were in 700 feet of stacked…

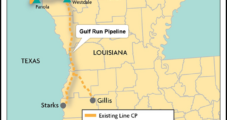

Sempra Building ‘Strong’ LNG Franchise in North America, Says CEO

Sempra Energy’s planned portfolio of liquefied natural gas (LNG) export facilities is among the most competitive in North America, according to CEO Jeffrey Martin, who on Thursday outlined progress on the three big projects in Louisiana, Texas and Mexico. “We think we have built a strong franchise in our LNG business, and to fund its…

Pioneer Natural Sees Federal Oil, Natural Gas Drilling Ban as Biggest Industry Exposure if Biden Hangs On

Permian Basin heavyweight Pioneer Natural Resources Co.’s executive team sees a possible drilling ban on federal property as the biggest exposure facing the oil and gas industry if Joseph R. Biden Jr. hangs on to win the presidency, management said Thursday. Assuming that Republicans maintain a majority in the Senate, there “should be no effect…

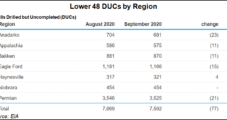

Weatherford Forecasting Slow Recovery in North America, but DUCs Lining Up

Houston-based Weatherford International plc has emerged from Chapter 11 with yet another CEO at the helm, who has charged the executive team to be “relentlessly focusing” on extending its global options and improving liquidity. Girish Saligram, who took the helm less than a month ago, is the third CEO in three years for the battered…

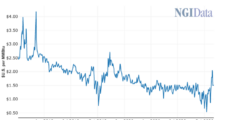

Plains, Enable Execs Cautiously Upbeat on Lower 48 Activity, Higher Natural Gas Prices

No matter who becomes the U.S. president, midstream executives are optimistic about the upcoming year given the improved price outlook for natural gas and the level of activity that has been spurred by producer customers, particularly in the Haynesville Shale. Speaking early Tuesday on the third quarter earnings call, Plains All American LP CEO Willie…

Williams Reports Record Appalachian Natural Gas Volumes Amid Stronger Pricing

Midstream giant Williams reported record natural gas gathering and processing (G&P) volumes in the Appalachian region during the third quarter, driven by higher prices in the region. Gross gathering volumes for the Northeast G&P segment rose 8% year/year (y/y) to 9.4 Bcf/d, while gross processing plant inlet volumes swelled by 17% to 1.4 Bcf/d, management…

Range Remaining Disciplined Despite Improving Natural Gas Outlook

Range Resources Corp. has ended production curtailments imposed in September and October in response to weak Appalachian natural gas prices, but even with an improved outlook, there are no plans to increase activity. Range cut 210 MMcf/d of natural gas production during the second half of September and most of October as Appalachian storage levels…

Callon Delivering Economic Returns in Permian, Eagle Ford at Current Strip Prices, Says CEO

Houston-based Callon Petroleum Co., whose portfolio stretches across the Permian Basin’s two major formations and across the Eagle Ford Shale, reduced costs and delivered “near-term economic returns” at current strip prices during the third quarter, the CEO said. Net production jumped 170% to 102,000 boe/d year/year, above expectations, while capital spending was $38 million, below…

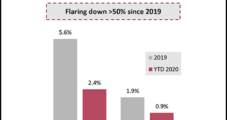

Diamondback Reduces Permian Flaring 74%, Discounts Any Merger Talk

Permian Basin pure-play Diamondback Energy Inc. improved its environmental stewardship in the third quarter, with only 0.5% net natural gas production flared, down 74% year/year. The operations also are strong enough to not look for any merger partner, CEO Travis Stice said. The Midland, TX-based independent reduced its lease operating expenses and general/administrative costs in…