The revival of the U.S. industrial sector will be “the most significant driver” to higher long-term natural gas prices, lifted by new ethylene crackers, ammonia plants and natural gas-to-liquids (GTL) facilities fed by unconventional natural gas, according to an analysis by Raymond James & Associates Inc.

Doesn

Articles from Doesn

Monterey Shale Offers Oil, ‘Real Dollars,’ Says Consultant

The Monterey Shale’s oil reserves could offer California a way out of any economic shortfall, according to Navigant Consulting’s energy director.

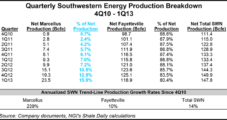

Southwestern Hitting ‘Full Stride’ in Marcellus

Southwestern Energy Co. is producing about 400 MMcf/d in the Marcellus Shale and doesn’t foresee any constraints in moving natural gas to markets north or south for the next couple of years, executives said Friday.

Colorado Considers Groundwater, Setback Drilling Rules

The Colorado Oil and Gas Conservation Commission (COGCC) has drafted proposed rules for sampling and monitoring groundwater before and after new wells are drilled, as well as changes to setbacks, which formalizes some procedures that the industry had begun voluntarily last year (see Shale Daily, Aug. 4, 2011).

30-Day Comment Period on Frack Rules Begins in New York

Three key lawmakers in New York say one month isn’t long enough for the state Department of Environmental Conservation (DEC) to receive public comments on proposed rules governing high-volume hydraulic fracturing (HVHF), and they are asking the agency for an extension.

West Virginia Supreme Court Rules Against Landowners

The West Virginia Supreme Court of Appeals has ruled that state law doesn’t give landowners the right to seek judicial review of well permits issued by the Department of Environmental Protection (DEP). However, the appeals court urged lawmakers to consider changing the law to give landowners more say.

Eagle Ford an Oil Production Barn Burner, Say Analysts

The Eagle Ford Shale of South Texas is likely the biggest potential driver of U.S. oil production growth for the next five to 10 years with production on track to pass 1 million b/d by the middle of next year and 1.7 million b/d by the end of 2015, analyst at Raymond James & Associates said in a note Monday.

EOG’s Papa: Natural Gas Still a ‘Money Loser’

EOG Resources Inc. CEO Mark Papa said the company has no plans to sell its estimable onshore natural gas leaseholds. But he also doesn’t expect management to spend much time or money on the plays in 2013, he told analysts last week.

EOG’s Papa: Natural Gas Still a ‘Money Loser’

EOG Resources Inc. CEO Mark Papa said the company has no plans to sell its estimable onshore natural gas leaseholds. But he also doesn’t expect management to spend much time or money on the plays in 2013.

Marcellus, Eagle Ford Ready With More Gas, Barclays Finds

The Marcellus and Eagle Ford shales have exactly what the U.S. gas market doesn’t need right now: more gas on the way, according to natural gas analysts at Barclays Capital. They titled their latest note — an analysis of the effects of upcoming pipeline debottlenecking in the two plays — “Unleashing a Caged Monster.”