Colorado’s Democratic Gov. Jared Polis signaled during his recent state of the state address that his administration would continue its work to meet stringent emissions reduction targets. Some governors are sharing some of their energy strategies in the annual state addresses. Polis, whose state includes the prolific Denver-Julesburg Basin and Niobrara formation, oversees one of…

Denver-Julesburg Basin

Articles from Denver-Julesburg Basin

Williams Cements Top DJ Natural Gas Gathering Spot with $1.27B Cureton, RMM Acquisitions

Williams has secured its spot as the largest natural gas gatherer in the Denver-Julesburg (DJ) Basin by closing two previously announced midstream acquisitions valued at a combined $1.27 billion. Williams acquired Cureton Front Range LLC, whose assets include gas gathering pipelines and two processing plants serving producers across 225,000 dedicated acres. Williams also purchased private…

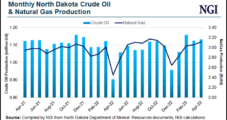

Bakken Natural Gas Egress Projects Moving Forward as Prices Still Sluggish

Some relief could be on the horizon for Bakken Shale oil producers facing punishingly low prices for their associated natural gas, as efforts to add takeaway capacity out of the basin are advancing. North Dakota Pipeline Authority Director Justin Kringstad provided an update on two projects during a press briefing on June 13. Kinder Morgan…

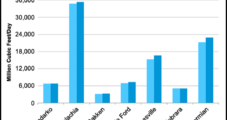

Domestic Natural Gas Output to Inch Higher in July, Averaging 97.34 Bcf/d, Says EIA

Natural gas production from the Lower 48’s top seven basins is expected to climb ever so slightly in July to about 97.34 Bcf/d, about 84 MMcf/d higher than in June, according to the U.S. Energy Information Administration (EIA). The Drilling Productivity Report (DPR) provides month/month natural gas and oil production forecasts for the Anadarko, Appalachia…

Colorado Expands Natural Gas, Oil Regulatory Body to Oversee Alternative Energies

Colorado Gov. Jared Polis earlier this week (May 22) stamped a slew of legislation that aims to propel the state toward its target of 100% renewable energy by 2040, including a bill rebranding and expanding oversight for the Colorado Oil & Gas Conservation Commission (COGCC). State Senate Bill (SB) 23-285, aka Energy & Carbon Management…

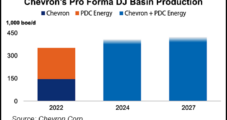

Colorado Becoming ‘Top 5’ Global Natural Gas, Oil Target with PDC, Says Chevron CEO

In a stealth move Monday, Chevron Corp. snapped up Denver-based independent PDC Energy Inc., a transaction that builds the Permian Basin inventory and adds enough heft in Colorado to become a “Top Five” global asset. Chevron CEO Mike Wirth led a conference call early Monday to discuss the all-stock deal, valued at $6.3 billion, or…

Quantum, Bison Commit $500M-Plus for Another DJ-Focused E&P

Quantum Energy Partners and the Bison Oil & Gas management team have committed more than $500 million to launch another acquisition-minded explorer that would be focused on the Denver-Julesburg (DJ) Basin in Colorado and Wyoming. Bison has operated in the DJ since 2015, forming and monetizing several partnerships. Last year Civitas Resources Inc., the largest…

EOG Resources Strikes Upbeat Tune on Natural Gas, Oil Volumes

EOG Resources Inc., a multi-basin exploration and production firm, said its strong fourth quarter and full-year 2022 results were powered by robust natural gas and oil demand, price spikes and steady production activity. For the year, EOG said, the natural gas prices it fetched jumped 49% from a year earlier, while crude prices increased 42%.…

Poco Nabs Top Environmental Rating for DJ Wells

Private exploration and production (E&P) operator Poco Holdco LLC received Project Canary’s highest possible environmental assessment rating for most of its Denver-Julesburg (DJ) Basin operations in Colorado. The E&P, a branch of private energy investment and management company Providence Energy Ltd., clinched Denver-based Project Canary’s “Platinum” certification for 22 operated horizontal wells at two wellsites. …

Sitio, Brigham Complete $4.8B Merger to Form U.S. Mineral, Royalties Giant

Minerals firm Sitio Royalties Corp. closed the books on a successful merger with Brigham Minerals Inc., combining “two of the largest public companies in the mineral and royalty sector,” the companies said. The $4.8 billion all-stock transaction has added 15,000 boe/d of oil-weighted pro forma production to Denver-based Sitio’s portfolio, which now stands at about…