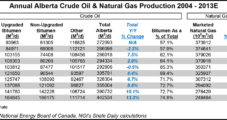

Horizontal drilling and hydraulic fracturing has powered the biggest increase since the 1970s in Alberta oil production from flowing wells outside the northern bitumen sands belt, says the provincial Energy Resources Conservation Board (ERCB).

Commodity

Articles from Commodity

CFTC’s Chilton Sends Transaction Fee Proposal to OMB

In a letter to the Office of Management and Budget (OMB), Commodity Futures Trading Commissioner Bart Chilton Wednesday proposed that the agency be allowed to impose a targeted fee on transactions in the derivatives markets.

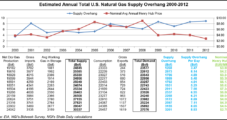

Shale Market Approaching ‘Guillotine Moment’

The torrent of natural gas production coming out of North America’s shale plays reminds Jim Duncan, chief analyst and commodity market strategist at ConocoPhillips Gas & Power, of the opening lines of “A Tale of Two Cities,” Charles Dickens’ epic novel of the French Revolution.

Shale Market Approaching ‘Guillotine Moment’

The torrent of natural gas production coming out of North America’s shale plays reminds Jim Duncan, chief analyst and commodity market strategist at ConocoPhillips Gas & Power, of the opening lines of “A Tale of Two Cities,” Charles Dickens’ epic novel of the French Revolution.

Gensler to Congress: CFTC Needs the Funding to Go After Bad Actors

President Obama’s request for a spending increase for the Commodity Futures Trading Commission (CFTC) in fiscal year (FY) 2014 is warranted because of the expanded role of the agency in regulating the futures and swaps markets, Chairman Gary Gensler told a House panel Friday. But Commissioner Scott O’Malia argued the agency failed to make a case for a budget hike.

CFTC Gives End-Users Relief from Reporting, Recordkeeping Requirements

The Commodity Futures Trading Commission’s (CFTC) Division of Market Oversight (DMO) Friday issued no-action relief for end-users from certain reporting and recordkeeping requirements under the Dodd-Frank law. The requirements were to go into effect on Wednesday.

CFTC Gives End-Users Relief from Reporting Requirements

The Commodity Futures Trading Commission’s (CFTC) Division of Market Oversight (DMO) Friday issued no-action relief for end-users from certain reporting and record keeping requirements under the Dodd-Frank law. The requirements were to go into effect on Wednesday.

AGA Seeks Guidance on Physical Contracts Under Dodd-Frank

To ensure compliance with Commodity Futures Trading Commission (CFTC) regulations, the American Gas Association (AGA) has asked the agency to clarify the extent to which non-financial contracts for the physical delivery of natural gas are within the scope of the Dodd-Frank Wall Street Reform Act’s regulation of “swaps.”

CFTC Sequestration May Stall Dodd-Frank Reforms

The Commodity Futures Trading Commission (CFTC), a small agency with the herculean task of regulating the derivatives and futures markets, could face severe budget cuts that would prevent it from implementing many of the reforms proposed under the Dodd-Frank Wall Street Reform and Consumer Protection Act, said Senate Agriculture Committee Chairwoman Debbie Stabenow (D-MI) last Wednesday.

CFTC Sequestration May Stall Dodd-Frank Reforms

The Commodity Futures Trading Commission (CFTC), a small agency with the herculean task of regulating the derivatives and futures markets, could face severe budget cuts that would prevent it from implementing many of the reforms proposed under the Dodd-Frank Wall Street Reform and Consumer Protection Act, said Senate Agriculture Committee Chairwoman Debbie Stabenow (D-MI) Wednesday.