Chesapeake Energy Corp. has signed its first binding agreement to buy LNG as it advances a strategy unveiled two years ago to gain exposure to the international gas market. The company said it has signed a sales and purchase agreement (SPA) to buy 0.5 million metric tons/year (mmty) of the super-chilled fuel from the proposed…

Tag / Chesapeake Energy

SubscribeChesapeake Energy

Articles from Chesapeake Energy

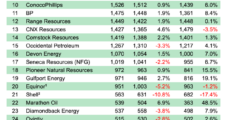

Natural Gas M&A Uptick Said Likely Following Oil-Focused Deal Spree

Upstream mergers and acquisitions (M&A) had a banner year in 2023 in the oil and gas sector, with dealmaking reaching a whopping $192 billion total, according to the latest quarterly tally by Enverus Intelligence Research (EIR). While only $6 billion of those transactions were focused on natural gas, versus $186 billion in deals targeting crude…

Chesapeake Working to Diversify LNG Supply Deals, Gain Price Exposure in Asia, Europe

While Chesapeake Energy Corp. works to finalize its natural gas supply deals with LNG buyers, management says it’s narrowing down opportunities to link more of its Haynesville and Marcellus shale supply to international benchmarks in the months to come. Chesapeake currently has tentative agreements with liquefied natural gas traders that could link up to 3…

Chesapeake Prepared to Expand Natural Gas Drilling in 2024 Ahead of LNG Export Growth

Chesapeake Energy Corp. has turned to another global commodity trader to help expose more of its U.S. natural gas production to international markets, inking a tentative deal with Vitol Inc. to sell up to 1 million metric tons/year (mmty) of LNG. The heads of agreement (HOA) follows one that Chesapeake signed earlier this year with…

Upstream Dealmaking at Full Throttle with ExxonMobil, Chevron Deals, and More Consolidation Said Likely

Dealmaking in the U.S. oil and natural gas upstream segment was on cruise control between July and September, with an estimated $14 billion spent for 25 transactions, but two mega-mergers announced this month may signal that transactions to year’s end may go into overdrive. A summary of 3Q2023 upstream merger and acquisition (M&A) activity, compiled…

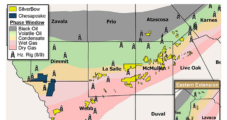

SilverBow Buys Chesapeake’s South Texas Assets, Adding Targets in Eagle Ford and Austin Chalk

SilverBow Resources Inc. agreed Monday to acquire Chesapeake Energy Corp.’s natural gas and oil assets in South Texas, a deal that would create the largest publicly held Eagle Ford Shale pure-play. Chesapeake would receive $700 million for the assets, including $650 million at closing and a $50 million deferred payment one year after the transaction…

Chesapeake Settlement Voided in Pennsylvania Natural Gas Royalty Dispute

A federal court has vacated a 2021 settlement that awarded more than $9 million to Pennsylvania landowners that alleged underpayment of royalties by Chesapeake Energy Corp. The 2021 settlement, filed in the U.S. Bankruptcy Court for the Southern District of Texas, was reached following Chesapeake’s Chapter 11 bankruptcy reorganization. Lessors argued that the third-largest publicly…

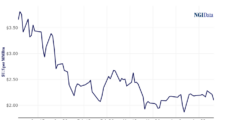

Chesapeake Won’t Cut More Activity as Management Expects Stronger Natural Gas Prices in 2024

Despite a steep drop in natural gas prices since the beginning of the year, Chesapeake Energy Corp. has no plans for now to cut activity further in 2023 as management sees an opportunity to be better positioned for a rebound in 2024. “We believe our financial flexibility is a competitive strength, and we intend to…

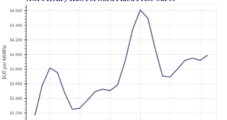

Natural Gas ‘Price Plunge’ Said to Make Even Top Basins Unattractive for Investment

The decline in U.S. natural gas prices, combined with elevated costs to drill a well, are forecast to slow down drilling and completions (D&C) activity in the gassy basins of the Lower 48. Rystad Energy Vice President Serik Omarov in a note said the gas price decline has created uncertainty for exploration and production (E&P)…

View From Wall Street – U.S. Natural Gas Production Cuts Needed to Salvage 2023 Prices

Lower natural gas output volumes are needed to reverse suddenly weak prices in 2023, several analysts said in new outlooks. Yet, they also cautioned exploration and production (E&P) firms against scaling back too aggressively because U.S. export demand is poised to surge in coming years. “Prices have been spiraling,” and “there is little upside potential…