Natural Gas Prices | E&P | NGI All News Access | Shale Daily

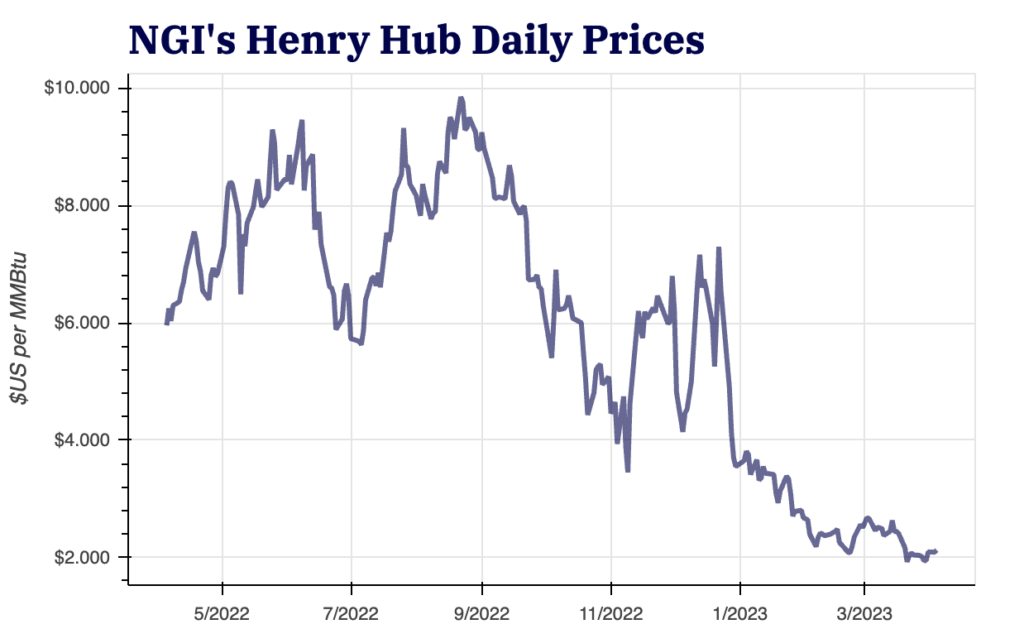

Natural Gas ‘Price Plunge’ Said to Make Even Top Basins Unattractive for Investment

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |