Las Vegas, NV-basedNV Energy Inc.’sshareholders on Wednesday “decidedly” approved the power utility’s acquisition by billionaireWarren Buffett-led Berkshire Hathaway’ MidAmerican EnergyHoldings Co., a $5.59 billion deal announced last May (seeDaily GPI,May 31). Speaking at a special stockholders’ meeting called for the vote, NV Energy CEOMichael Yackirasaid the transaction is expected to close in the first quarter next year, assuming that all customary closing conditions are met, including approvals from theFederal Energy Regulatory Commissionand theNevada Public Utilities Commission.

Assuming

Articles from Assuming

SM Energy Selling Anadarko Basin Properties

Denver-based SM Energy Co. is marketing all of its properties in the Anadarko Basin, including its Granite Wash interests. The sale of the gas-weighted assets is part of normal high-grading activities, the company said Wednesday. Proceeds could be spent in the Permian Basin or in the Eagle Ford Shale, analysts speculated Wednesday.

Researchers Differ Over Shale’s Impact on Ohio Housing

Researchers commissioned by state government agencies have offered differing opinions over whether a housing shortage is on the horizon in eastern Ohio, where development is ramping up in the state’s portions of the Marcellus and Utica shales.

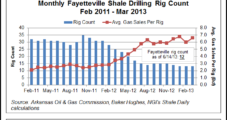

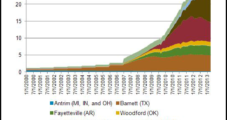

The Fayetteville Shale is Dry, But It’s Hardly Dried Up

“We have thousands and thousands of well locations,” he said at the UBS Global Oil and Gas Conference. “We’ll be drilling at this pace for many years to come, assuming the [Nymex] strip pricing that we have today. We do plan to drill close to 400 wells this year and that certainly, of all of our operations, can flex more than any others as we need to respond to gas prices, one way or the other [see Shale Daily, May 24].”

New Onshore Mantra: Value Over Volumes

U.S. explorers took about a decade to claim and begin producing the huge onshore unconventional bounty. Now that they’ve got their rocks of plenty in hand, the task today is determining what to keep and what to toss, according to a Credit Suisse analyst.

Algonquin Power Acquiring New England Gas Co.

Algonquin Power & Utilities Corp. (APUC) is assuming Laclede Group Inc.’s right to buy New England Gas Co. (NEG), Laclede said late Monday.

Eagle Ford Shale Blooming for Rosetta

During the third quarter, Houston-based Rosetta Resources Inc. quickened its pace in the Eagle Ford Shale where it grew production 68% from the year-ago level; production was also wetter. Management also disclosed Thursday that the company is testing two new areas outside of the Eagle Ford.

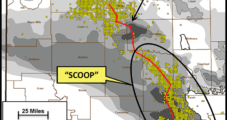

Here’s The SCOOP: Continental Uncovers New Play in Old Field

Continental Resources Inc. disclosed Tuesday that it has begun reworking a legacy shale play in south-central Oklahoma geographically similar to the Bakken, Marcellus and Eagle Ford shales that could add 1.8 million boe to its reserves in the next few years.

Industry Briefs

Natural gas and electric utility bills will decrease in the fourth quarter for Xcel Energy’s Colorado customers, assuming state regulators approve the combination utility’s proposed new rates, effective Oct. 1. Xcel asked the Colorado Public Utilities Commission (PUC) to OK monthly gas utility bills going down by an average of $6.15 for residential customers and $23.16 for small businesses. Commodity prices for the two customer groups will be 44.19 cents/therm and 43.84 cents/therm, respectively, compared to rates of 52.11 cents/therm and 52.33 cents/therm in 4Q2011. For electric customers, monthly bills are expected to drop for residential ($3.21) and small business ($26.79).

Chevron Likes Shale but Is Focused on Value, Says CEO

Chevron Corp. plans to continue to make acquisitions in unconventional plays around the world but the company likely will go it alone when it does, CEO John Watson said Friday.