Anadarko Petroleum Corp. has a big stack of opportunities yet to delineate in the U.S. onshore, including in Colorado’s Denver-Julesburg (DJ) and Permian basins, while costs are coming down as efficiencies are moving up.

Anadarko

Articles from Anadarko

Anadarko CEO Says ‘Things Feel Better Today’ Than Three Months Ago

Anadarko Petroleum Corp. has a big stack of opportunities yet to delineate in the U.S. onshore, including in Colorado’s Denver-Julesburg (DJ) and Permian basins, while costs are coming down as efficiencies are moving up.

Anadarko Reaping $1.3B From U.S. Onshore Asset Sales

Anadarko Petroleum Corp. said late Wednesday it has agreements in place to capture $1.3 billion from monetizing stakes in three U.S. onshore projects, including a majority stake in the Maverick Basin system in South Texas.

FourPoint Buying Chesapeake’s Remaining Anadarko Basin Portfolio for $385M

One day after announcing it has sold stakes in onshore wells across the country, Chesapeake Energy Corp. on Wednesday secured an agreement to sell its remaining natural gas-heavy Anadarko Basin property for $385 million to a return buyer, privately held FourPoint Energy LLC.

Brief — Chesapeake

Chesapeake Energy Corp.’s corporate credit rating was cut to “CCC” from “CCC+” with a “negative” outlook by Standard & Poor’s Ratings Services (S&P) following reports that the company is working with Kirkwood & Ellis LLP to improve its balance sheet and address upcoming maturities (see Shale Daily,Feb. 8). “The downgrade reflects the potential that Chesapeake could pursue a further debt exchange over the next 12 months and that we would view a transaction as distressed rather than opportunistic, and which we would consider a selective default,” said credit analyst Paul Harvey. The financial picture appears “very weak over the next 24 months based on our natural gas and crude oil prices assumptions. Under these challenging conditions, we expect debt leverage to exceed 12 times on average. Additionally, liquidity is likely to be challenged under these low prices, both from diminished cash flows and potential reductions in the company’s borrowing base.”

Anadarko Shutters Final NatGas Well at Independence Hub in GOM

The last natural gas well producing at the Independence Hub in the deepwater Gulf of Mexico (GOM) was shuttered in December, less than nine years after the facility ramped up, Anadarko Petroleum Corp. said.

Heidelberg Production Begins in GOM Lower Tertiary

Anadarko Petroleum Corp. and its partners have ramped up production from the first three wells at the Heidelberg field of the Lower Tertiary Trend in the Gulf of Mexico, the producer’s second major deepwater truss spar development in two years.

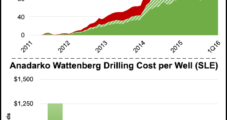

Anadarko Says Permian’s Delaware, Wattenberg Exceeding Production Guidance

Anadarko Petroleum Corp. said Thursday onshore oil production is exceeding expectations, particularly from the Permian Basin’s Delaware sub-basin and Wattenberg field, leading it to raise 4Q2015 guidance by as much as 5%.

Anadarko Fined $159.5M For Macondo-Related CWA Violations

Anadarko Petroleum Corp., a minority partner in the doomed BP plc-operated Macondo well, said it is reviewing whether to appeal a $159.5 million penalty for violating the Clean Water Act — far less than the $1 billion-plus penalty sought by federal prosecutors.

NGI The Weekly Gas Market Report

[Article Headline]

Anadarko Petroleum Corp. confirmed Wednesday it approached Apache Corp. about a potential buyout but was rejected, with no “discussions of substance” occurring.