E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Anadarko CEO Says ‘Things Feel Better Today’ Than Three Months Ago

Anadarko Petroleum Corp. has a big stack of opportunities yet to delineate in the U.S. onshore, including in Colorado’s Denver-Julesburg (DJ) and Permian basins, while costs are coming down as efficiencies are moving up.

During a wide ranging conference call Tuesday to discuss first quarter performance, CEO Al Walker and his management team laid out reasons why the super independent is relying on patience backed up with a solid balance sheet to wait out higher commodity prices. The business environment remains strained, but it’s better than it was a few months ago, the CEO said.

“I think it…goes without saying that things feel better today than they did 90 days ago, both for our industry and for investors,” Walker said. “The very fragile energy capital markets we’ve seen for most of the first quarter appear to be stabilizing, the outlook for commodity prices are improving and I think for industry our operating environment is deftly strengthening.”

Anadarko’s capital spending is 50% lower this year than in 2015 and 70% below 2014 spend.The dividend was cut 81%, which should save about $450 million a year. And operationally, things are looking better.

The U.S. onshore team significantly reduced capital and the rig count, with capital spending in the domestic operations off 71% and the operated rig fleet down by two-thirds. Lease operating expenses (LOE) improved 22% from a year ago — the best in a decade, Walker said. LOE averaged $2.77/boe.

Of the total capital spent in the first quarter, $530 million was directed to the U.S. operations, including $336 million in the Lower 48.

Average volumes worldwide totaled 827,000 boe/d during 1Q2016, versus 934,000 boe/d a year ago. U.S. natural gas sales declined, averaging around 2.30 Bcf/d from 2.74 Bcf/d. Domestic oil/condensate sales fell slightly to 232,000 b/d from 237,000 b/d, while natural gas liquids sales dropped to 122,000 b/d from 136,000 b/d.

Anadarko’s gas volumes included 2.00 Bcf/d from the U.S. onshore and152 MMcf/d from the Gulf of Mexico (GOM) deepwater. It also produced 165,000 b/d of oil/condensate from the U.S. onshore, with the deepwater adding 53,000 b/d.

Once prices strengthen, Anadarko has a healthy backlog of wells to complete, with about 230 drilled but uncompleted wells mostly in the DJ, Delaware and Eagle Ford Shale.

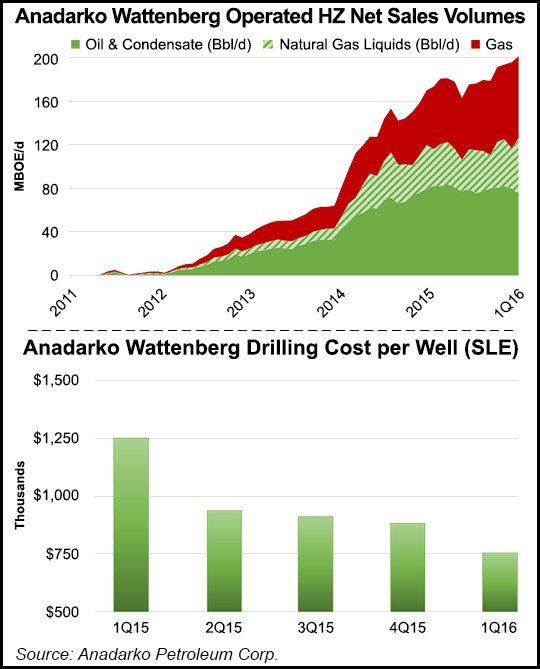

“Our liquids mix continues to increase, and our well costs in the DJ were reduced 11% from the year before to a level today of about $2.4 million per well,” Walker said. In the Permian’s Delaware sub-basin, wells cost about $6.2 million to complete, $1 million/well less than in the fourth quarter.

“What can you expect from us through the balance of the year? Do not expect us to increase our capital spending this year even if oil exceeds $50/bbl,” he said. “We’ll be very patient as we look beyond 2016 to a sustained higher price environment to increase capital and return to a growth mode if warranted.”

In the venerable DJ, Wattenberg provided Anadarko with its usual reliable results, with well costs falling to $2.4 million from a year ago, down 11%. Gassy Wattenberg volumes by themselves jumped 11% or by 24,000 boe/d. Rockies volumes overall averaged 355,000 boe/d in the quarter, 6% better sequentially but down 2% year/year.

Anadarko, long one of Colorado’s top producers, is encouraged by the Colorado Supreme Court’s ruling on Monday, which struck down a hydraulic fracturing ban in Longmont and a moratorium in Fort Collins (see related story). The state’s high court affirmed that the local government actions were preempted by state law and therefore were invalid and unenforceable. “We were certainly happy with the Supreme Court and believe it made the correct decision,” Walker said. It makes business easier in the state.

In its growing Delaware sub-basin of West Texas, net resources have doubled from a year ago on delineation efforts, rising to more than 2 billion boe. Net volumes jumped 47% year/year to 38,000 boe/d, while well costs improved by 14%. Average wells now cost around $6.2 million to complete, versus $7.2 million in early 2015.

Like a year ago and in the fourth quarter, Anadarko invested no money and ran no rigs in the Marcellus Shale, but the play still produced 91,000 boe/d net, versus year-ago output of 99,000 boe/d net.

The GOM, where Anadarko is a major player, averaged volumes of about 79,000 boe/d, with liquids climbing 25% year/year. The increase mostly was attributed to outperformance from the Lucius spar, first production ahead of schedule at Heidelberg and contributions from a tieback program at various installations. Anadarko now has up to 30 identified development tieback opportunities in the GOM.

There were hiccups financially during 1Q2016 with Anadarko posting a net loss of $1.03 billion (minus $2.03/share), versus a year-ago loss of $3.26 billion (minus $6.45). Excluding one-time items, losses totaled $1.12/share from a loss of 72 cents. Low commodity prices stomped revenue, which plunged 28% to $1.67 billion.

Looking forward, U.S. gas volumes in 2Q2016 are expected to decline sequentially, averaging 2.14-2.18 Bcf/d. Domestic gas volumes also are forecast to decline through the year, with full-year guidance averaging 2.06-2.08 Bcf/d.

“Year to date, we’ve closed monetizations totaling $1.3 billion and are currently in the process of advancing another $700-plus million of divestitures,” Walker said. “We’ve also removed perceived uncertainty by issuing $3 billion of investment-grade bonds to refinance near-term maturities…These actions combined with our continued focus on financial discipline, operational excellence and best-in-class capital allocation, support our ability to enhance and preserve value in a volatile market environment.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |