Faster cycle times and strong well productivity drove a production beat for multi-basin independent Coterra Energy Inc. during the third quarter, a performance that led the explorer to increase guidance for the year. The Houston-based exploration and production (E&P) giant, which works in the Anadarko and Permian basins, as well as the Marcellus Shale, expects…

Anadarko

Articles from Anadarko

Devon Finds Permian Delaware Tops Targets in ‘Every Flavor of Commodity Price’

Devon Energy Corp. has a bundle of opportunities from which to choose when it allocates its capital in the Lower 48, but it has always come down to the price of natural gas and oil, a top executive said this week. COO Clay Gaspar, speaking with analysts during the first quarter 2023 conference call, explained…

Iron Horse Expanding Natural Gas Processing in Anadarko Basin

Iron Horse Midstream is adding another natural gas cryogenic processing plant at its 120-acre complex in Grady County, OK, in the heart of the Anadarko Basin. The Dallas-based firm said the 200 MMcf/d plant would boost natural gas processing capacity in the SCOOP/STACK (South Central Oklahoma Oil Province and Sooner Trend of the Anadarko Basin,…

BCE-Mach III Grows Natural Gas Footprint in Anadarko as Prices Rise

Anadarko Basin-focused BCE-Mach III LLC is beefing up its natural gas-weighted assets with a deal to add 18,200 net acres and 17 MMcfe/d to its portfolio amid high commodity prices. The company, a partnership of Houston-based Bayou City Energy Management LLC and Oklahoma City-based Mach Resources LLC, said this week it recently closed on the…

Ovintiv Moves to Streamline Costs, Debt by Focusing on Anadarko, Montney and Permian

Denver-based Ovintiv Inc. streamlined the business during 1Q2021 to focus only on the Anadarko, Montney and Permian basins as it eyes slashing debt to appease restless investors. With long-held but neglected shale properties in Canada’s Duvernay and the South Texas Eagle Ford sold off, the independent has accelerated a $4.5 billion total debt target timeline…

Enable Eyeing Increased Activity, Scale in Midcontinent After Merger

Oklahoma’s Enable Midstream Partners LP has seen an increase in drilling activity around its footprint as commodity prices have improved, with a “substantial” inventory of drilled but uncompleted (DUC) wells sitting behind the company’s system in the Anadarko and Williston basins. “These DUCs provide an inventory of wells producers can complete without investing additional drilling…

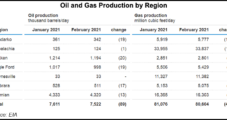

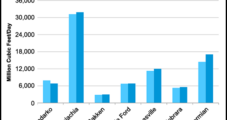

Natural Gas Production in Lower 48 to Continue Falling from January to February, EIA Says

Cumulative natural gas production from seven key U.S. onshore regions is set to fall by 472 MMcf/d from January to February, extending a downtrend that goes back to early 2020, according to updated projections published Tuesday by the Energy Information Administration (EIA). In its latest Drilling Productivity Report, EIA said it expects the Anadarko, Appalachian…

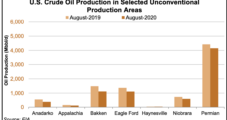

Oil, Natural Gas Production Slide to Continue Next Month in Key Lower 48 Unconventional Plays

Deflating oil and natural gas production from seven of the most prolific U.S. onshore unconventional plays is expected to continue in August, according to the Energy Information Administration (EIA). Total oil production from the Anadarko, Appalachian and Permian basins, and the Bakken, Eagle Ford, Haynesville and Niobrara formations is expected to decline to 7.49 million…

NGI The Weekly Gas Market Report

Ovintiv Keeping Eye on Natural Gas Prices as Shut-ins Reduce Output by 65,000 Boe/d

Denver-based Ovintiv Inc., whose broad oil and natural gas portfolio runs across the Permian and Anadarko basins and the Montney formation in Canada, is shelving some onshore work in the Eagle Ford, Bakken, Uinta and Duvernay formations, but it’s keeping a sharp eye on the direction of natural gas prices to determine when to boost activity.

NGI The Weekly Gas Market Report

EIA Forecasts Natural Gas, Oil Production Decline in May from Key Lower 48 Plays

Reflecting the impact of both the coronavirus pandemic and the global oil price war, natural gas and oil production from seven of the most prolific onshore U.S. unconventional plays is expected to decline in May compared with April, according to the Energy Information Administration (EIA).