Markets | Mexico | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report

Pipeline Imports of U.S. Natural Gas Unhindered Amid Russia-Ukraine Panic – Mexico Spotlight

This week was a manic time in natural gas markets globally, and Mexico was not without its share of drama.

Last Friday, Mexico’s Cenagas declared a rare critical alert on the Sistrangas national pipeline system, which meant some users would see natural gas restrictions. The alert was related to problems at a gas processing center in the southeast and was an “isolated incident,” a natural gas industry official told NGI’s Mexico GPI.

The situation was brought under control quickly, but it added to jitters over natural gas supply amid the Ukraine-Russia conflict. Worry was so high that state utility Comisión Federal de Electricidad (CFE) on Tuesday said it would use fuel oil and other alternate power generation sources in the event natural gas prices in Mexico became uneconomic.

“Speculation is that prices are going to rise considerably,” CFE executives said.

However, North American natural gas prices have remained relatively in check, albeit with pressure to the upside. Prices rose for a second straight day on Wednesday on the back of global supply worries and record prices for European natural gas.

The April Nymex gas futures contract was up 18.9 cents day/day on Wednesday to $4.762/MMBtu. The May contract gained 18.9 cents to close at $4.787.

Western powers so far have been hesitant to restrict Russian energy flows, although many major oil and gas firms have announced intentions to dump their Russian assets. Traders have also been hesitant to buy Russian oil and gas, analysts said.

“Despite the rising anti-Russian gas sentiment, day on day flows from Russia are largely unchanged,” Rystad Energy analyst Kaushal Ramesh said. Ramesh warned however that “fundamental drivers have by now taken a back seat in driving prices,” and this was likely to be the case for the foreseeable future.

Mexico natural gas imports from the United States have not yet been impacted. On Thursday, Mexico imported 5.80 Bcf via pipeline from the United States, and the 10-day average was 5.52 Bcf/d.

Mexico’s Central Bank Wednesday, meanwhile, slashed Mexico’s growth forecast for 2022 to 2.4% from a previous forecast of 3.2%, citing the conflict in Europe.

More LNG?

New liquefied natural gas (LNG) export buildout appeared as a major topic of interest in both the United States and Mexico in the wake of the conflict in Ukraine. Energy company executives commented on the fact in some quarterly earnings calls. In addition, the International Energy Agency on Thursday issued a 10-point plan to reduce reliance on Russian gas, which could mean more LNG flows into Europe.

Sempra Infrastructure CEO Justin Bird said the company had seen “a dramatic increase in the market interest” for its LNG projects including Energía Costa Azul Phase 1 and Vista Pacifico on Mexico’s Pacific Coast.

Mexico Prices

In Mexico, natural gas prices were basically flat on Wednesday (March 3) compared to where they were one week ago. NGI natural gas spot prices rose day/day in the Northeast, with Los Ramones up 16.7 cents to $4.856. Monterrey via the Mier-Monterrey system was up 16.6 cents to $4.658.

Tuxpan in Veracruz via Cenagas saw the spot price rise 16.2 cents to $5.372. In the West, the Guadalajara price was up 16.5 cents to $5.390. Farther north in El Encino, prices via Tarahumara were $4.814, 17.3 cents higher than the previous day. On the Yucatán Peninsula, the cash price at Mérida was $6.060 on Wednesday, up 15.6 cents.

Sistrangas

Mexico’s Sistrangas five-day line pack average was 6.598 Bcf on Wednesday (March 3), below the optimal line pack of 6.86-7.29 Bcf needed to guarantee sufficient pressure in the system. Following the critical alert, Cenagas once again advised users to maintain injections and withdrawals to their contractual quantities or risk facing penalties.

Demand on the Sistrangas on Wednesday was 4.571 Bcf, up from 4.536 Bcf a day earlier. Mexico gas production fed into the system was 1.261 Bcf, basically flat from a week earlier.

Southeast production dominated the total, with 704 MMcf/d from the region injected into the pipeline system.

According to calculations from the Gadex consultancy, pipeline imports from the United States into the Sistrangas were 3.165 Bcf on Wednesday, down from 3.335 Bcf a week earlier. LNG imports into the Sistrangas were 12 MMcf.

In regulatory news, Mexico market players have expressed concern around new tax rules on volumes transacted. They cited the lack of metering infrastructure for proper measurement of gas flows.

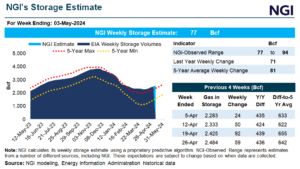

U.S. Gas Storage

On Thursday, the U.S. Energy Information Administration (EIA) reported a withdrawal of 139 Bcf natural gas for the week ending Feb. 25, in line with market expectations.

The South Central region posted a withdrawal of 35 Bcf. This included a 30 Bcf pull from nonsalt facilities and a decrease of 5 Bcf in salts, according to EIA. Until Mexico develops storage capability, this is the storage system most readily available to the country.

For the week ending Feb. 25, total working gas in the South Central region stood at 620 Bcf, down from 670 Bcf for the same time one year ago. The figure was also 108 Bcf lower than the average 728 Bcf in storage for the same day between 2018-2022, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |