Polish Oil and Gas Co., aka PGNiG, has scrapped one deal and signed another with U.S. developer Sempra related to North American liquefied natural gas (LNG) supply.

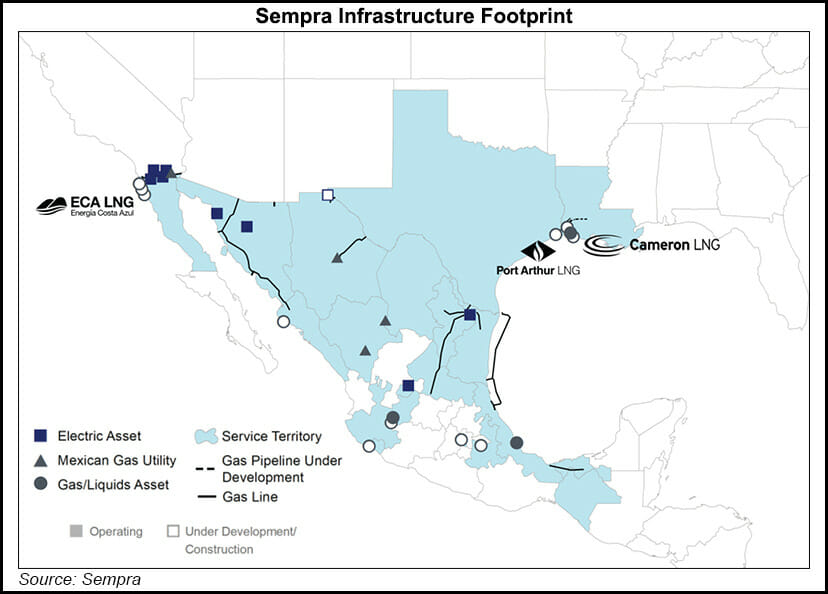

The memorandum of understanding (MOU) announced Tuesday was signed after PGNiG canceled a previous sale and purchase agreement (SPA) to buy 2 million metric tons/year (mmty) of LNG from Sempra’s planned Port Arthur, TX, export facility.

Under the new nonbinding agreement, Sempra and PGNiG are to work together to transition the Port Arthur SPA to Sempra’s North American LNG portfolio. The companies would also work toward a framework to report, mitigate and reduce greenhouse gas emissions “throughout the LNG value chain” as part of the MOU, PGNiG said.

PGNiG said it had terminated the SPA because of...