Mexico was set to receive its first cargo of carbon offset liquefied natural gas on Friday (July 16), according to a Thursday announcement by BP plc and Sempra.

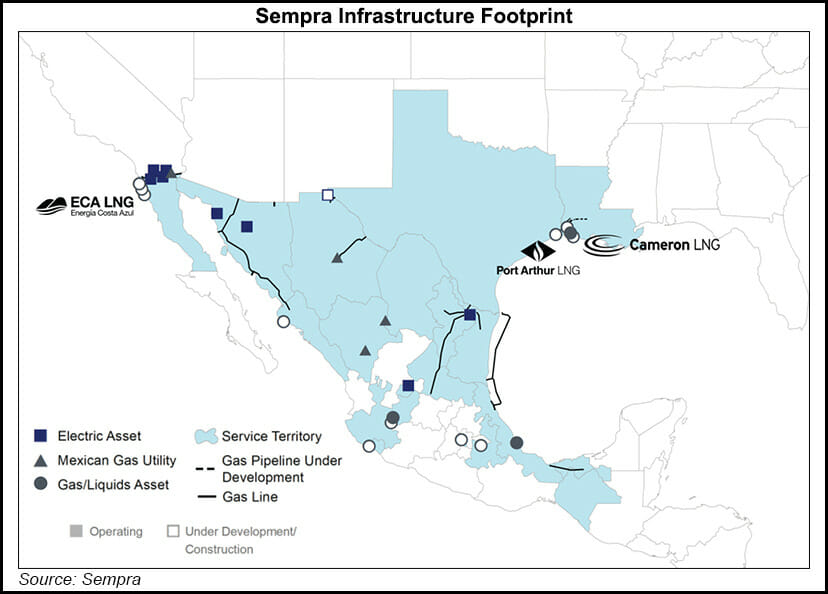

Subsidiaries of the firms inked a contract for delivery of the cargo to Sempra’s Energía Costa Azul (ECA) terminal on Mexico’s Pacific Coast.

Greenhouse gas (GHG) emissions from the cargo will be offset by BP Gas Marketing Ltd. retiring carbon credits sourced from its carbon trading portfolio on behalf of Sempra LNG, BP said.

Carbon dioxide and methane emissions associated with the cargo from the wellhead to the discharge terminal, aka well-to-tank, will be estimated using BP’s GHG quantification methodology for LNG, the supermajor said.

“These estimated emissions will be offset by retiring a...