A “rebalancing” of the global liquefied natural gas (LNG) market is closer than previously thought as supply outages linger and demand continues to grow, according to Morgan Stanley Research.

The rebalancing originally pegged for 2022 has “accelerated” into 2021, analysts led by Devin McDermott said.

In the United States, demand growth largely driven by LNG exports is expected to outpace supply additions as producers look to maintain or moderately grow output. Morgan Stanley expect production to grow by 2 Bcf/d this summer over last year, with demand increasing by 8 Bcf/d.

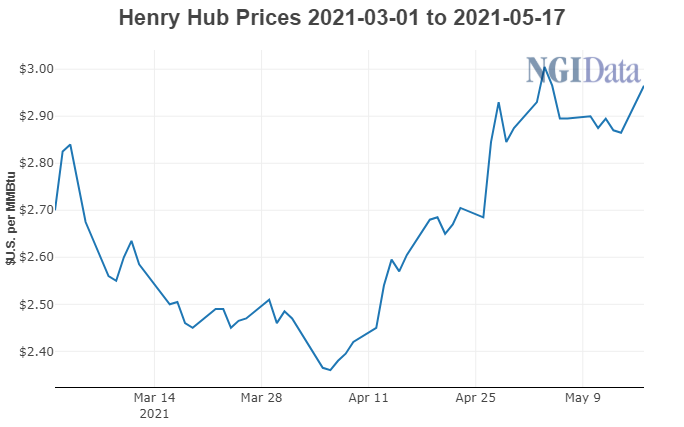

Still, production is trending “a bit high” against the firm’s forecast, the analysts said. That could pose a threat to Morgan Stanley’s full-year forecast of $3.00/MMBtu for Henry Hub...