TC Energy Corp. has inked a $1.14 billion agreement to sell the Portland Natural Gas Transmission System (PNGTS) to BlackRock Inc. and Morgan Stanley Infrastructure Partners as it pares debt and streamlines its North American pipeline business. The Calgary-based pipeline giant holds 61.7% ownership of PNGTS, a 295-mile, 290 million Dth/d line. Énergir LP subsidiary…

Tag / Morgan Stanley

SubscribeMorgan Stanley

Articles from Morgan Stanley

Analysts Warn Rising European Natural Gas Prices ‘Mask’ Overall Soft Demand – LNG Recap

Global natural gas prices are starting to tick upward once again as maintenance events and warmer weather appear to signal more demand for LNG, but analysts are warning a bearish summer could still lie ahead. After sliding for several weeks to the lowest points since 2021, prompt Asian and European prices began to rally again…

Oneok to Add Refined Products, Crude Oil Transportation Services with $18.8B Magellan Deal

Natural gas midstream company Oneok Inc. on Monday announced that it has agreed to purchase Magellan Midstream Partners LP for $18.8 billion, giving the Tulsa-based firm entry into the transportation of crude oil and refined products. Under the deal, Oneok would acquire all outstanding units of Magellan in a cash-and-stock transaction, resulting in a combined…

October Natural Gas Futures Drop a Third Straight Day on Fading Demand Forecasts

Natural gas futures faltered on Monday, extending to three days a losing streak that materialized alongside forecasts for cooler temperatures and moderating demand. The October Nymex contract dropped 12.0 cents day/day and settled at $4.985/MMBtu. November fell 12.4 cents to $5.022. At A Glance: Futures fall amid autumn weather Forecasts call for mild conditions Global…

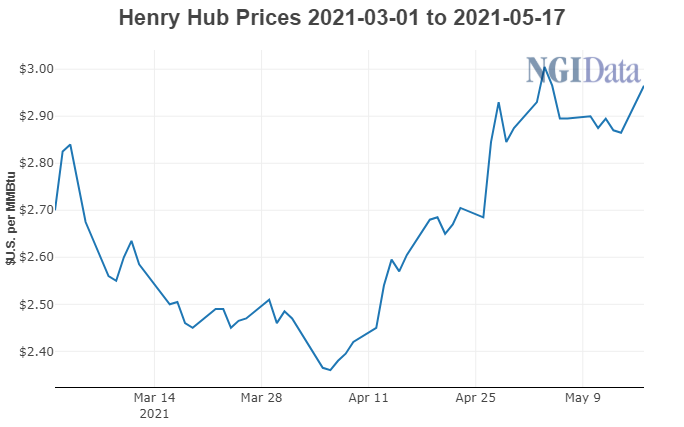

Morgan Stanley Says LNG Market Rebalance Near, Raises TTF, JKM Price Forecasts

A “rebalancing” of the global liquefied natural gas (LNG) market is closer than previously thought as supply outages linger and demand continues to grow, according to Morgan Stanley Research. The rebalancing originally pegged for 2022 has “accelerated” into 2021, analysts led by Devin McDermott said. In the United States, demand growth largely driven by LNG…

Brief — Brazos Midstream Sale

Brazos Midstream Holdings LLC and financial sponsor Old Ironsides Energy have agreed to sell subsidiaries working on developing the Permian Delaware sub-basin to North Haven Infrastructure Partners II (NHIP II) for about $1.75 billion. Closing is expected by the end of June. NHIP II is an investment fund managed by Morgan Stanley Infrastructure. After closing, Brazos would retain its name and management team, and it would operate as a portfolio company of NHIP II. Brazos is expanding cryogenic natural gas processing in West Texas, among other things. Jefferies LLC is financial adviser to Brazos, while RBC Capital Markets is financial adviser to Morgan Stanley Infrastructure.