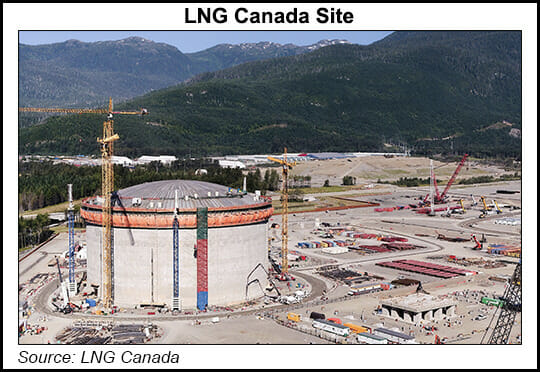

Construction on the first phase of the Royal Dutch Shell plc-led liquefied natural gas (LNG) export facility in British Columbia, known as LNG Canada, has hit the halfway point, with activity to accelerate in the coming months.

In a notice posted on the LNG Canada website Wednesday, management said the project had “just surpassed the 50% completion mark,” adding things were “moving swiftly” toward commissioning and start-up.

Management also noted the project has been able to reach major milestones “safely and on schedule” despite the Covid-19 pandemic. Those milestones include raising the roof on its LNG tank and the arrival of its main cryogenic heat exchanger and two precooler units.

Looking ahead, the first liquefaction module is expected to arrive on-site in...