Natural gas prices crested the $4.00/MMBtu mark last week, and though the gains may have come quickly, price may need to be higher to incentivize more coal in power generation to help balance the market, according to Raymond James & Associates Inc.

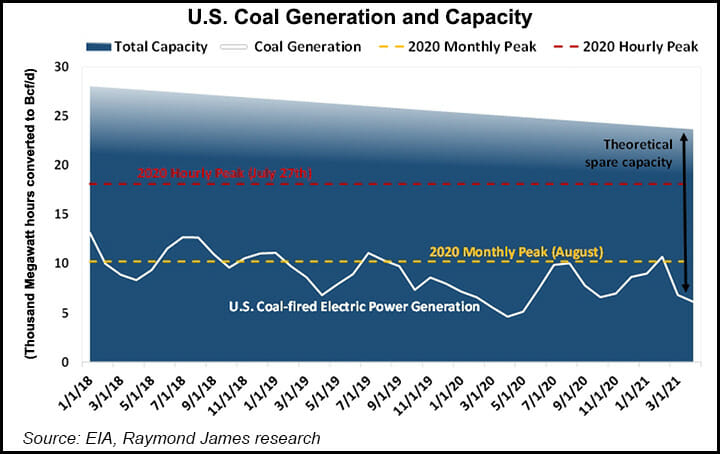

Coal’s share of the power generation stack would have to increase by more than 3 Bcf/d year/year in order to achieve this, Raymond James analysts said in a note to clients Monday. Whether the power market has the capability to achieve this, however, is the “biggest point of contention” among investors.

U.S. gas prices have had a “huge summer,” said analyst team led by J.R. Weston. The New York Mercantile Exchange 2021 strip has rocketed higher, largely on more constructive weather. While domestic liquefied natural gas (LNG)...