Despite fears about the Omicron variant of the coronavirus and rising global oil output, Raymond James Financial Inc. analysts are increasingly optimistic about strong crude prices through 2023. “Our bullish oil view over the next few years not only remains firm, but we’re actually increasing our long-term price forecast,” the analysts, John Freeman and Justin…

Tag / Raymond James

SubscribeRaymond James

Articles from Raymond James

Raymond James Raises Natural Gas Price Forecast as LNG, Mexico Demand Outlook Remains Bullish

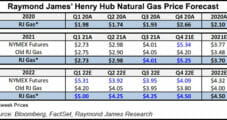

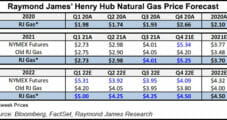

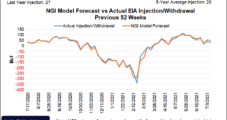

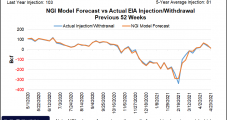

With limited global supplies and robust demand entering the peak winter season, Raymond James analysts this week boosted their already bullish natural gas price forecasts for this year and 2022. Analysts J.R. Weston and John Freeman said they raised their full-year 2021 Henry Hub average price forecast 6% to $3.70/MMBtu and their expectation for next…

Raymond James Sees More Upside for Natural Gas Prices in 2022, Raises Projections

With limited global supplies and robust demand entering the peak winter season, Raymond James analysts on Monday boosted their already bullish natural gas price forecasts for this year and 2022. Analysts J.R. Weston and John Freeman said they raised their full-year 2021 Henry Hub average price forecast 6% to $3.70/MMBtu and their expectation for next…

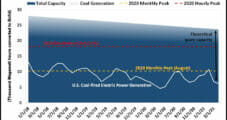

Even at $4.00, Higher Natural Gas Prices Needed, Says Raymond James

Natural gas prices crested the $4.00/MMBtu mark last week, and though the gains may have come quickly, price may need to be higher to incentivize more coal in power generation to help balance the market, according to Raymond James & Associates Inc. Coal’s share of the power generation stack would have to increase by more…

As Demand Further Strengthens, August Natural Gas Futures Extend Rally; Cash Prices Climb

Natural gas futures on Monday advanced for a seventh consecutive session as robust domestic cooling demand and strong liquefied natural gas (LNG) export levels continued to drive up prices that are at their highest levels since 2018. The August Nymex contract advanced 4.2 cents day/day and settled at $4.102/MMBtu. The prompt month gained nearly 11%…

June Natural Gas Futures Inch Higher Amid LNG Strength, Potential for Storage Depletion

Natural gas futures advanced for a second consecutive session on Monday, as traders mulled weather-driven demand potential, continued strong liquefied natural gas (LNG) volumes and the potential for light storage levels moving through the summer months. The June Nymex contract advanced 3.5 cents day/day and settled at $2.966/MMBtu. July rose 3.6 cents to $3.014. Spot…

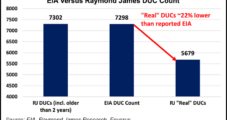

Lower 48 DUC Count Falling to ‘Normal’ by Year’s End, Says Raymond James

The Lower 48’s ample supply of drilled but uncompleted wells, aka DUCs, is coming down at a quick pace and is expected to reach “normal” levels by year’s end, tightening the oil supply according to Raymond James & Associates Inc. In a note to clients, Raymond James analyst John Freeman made the case that the…

DUC, DUC, Goose? Giant Disconnect Seen in Lower 48 Well Completions, Rig Count

Lower 48 well completion activity is at an all-time high, even as the rig count has fallen, which is leading to a huge disconnect that may not be sustained through 2020, according to an analysis by Raymond James & Associates Inc.

‘Stout’ Turnaround Expected Following Dip in Global Oil Demand

Oil prices, which spiked following attacks on Saudi oil infrastructure in mid-September, remain in flux beyond 2019, as questions swirl about whether a second quarter dip in demand was transitory or permanent.

Most Lower 48 E&Ps Still Exposed to 2020 Oil, Natural Gas Prices

U.S. explorers still have a lot of exposure to oil and natural gas prices in 2020 as the fourth quarter nears, but if oil prices move higher as many experts are forecasting, that strategy may prove to be a winner.