Regulatory | International | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Equinor Cleared to Keep Norwegian Natural Gas Output Near Capacity to Aid European Supplies

Norwegian regulators have approved revised production permits allowing Equinor ASA and its partners to continue pumping natural gas near maximum levels for export to Europe, as the continent looks to cut its dependence on Russian supplies.

Fields on the Norwegian Continental Shelf have been operating near maximum capacity amid strong demand and a war between Russia and Ukraine that threatens supplies in Europe. Equinor filed for revised permits to maintain high production from the Troll, Oseberg and Heidrun fields through the summer months and to postpone maintenance work.

Norway’s Ministry of Petroleum and Energy signed off on the adjusted permits, which would allow for more than 2 billion cubic meters (Bcm) of additional natural gas to reach Europe through the end of the year.

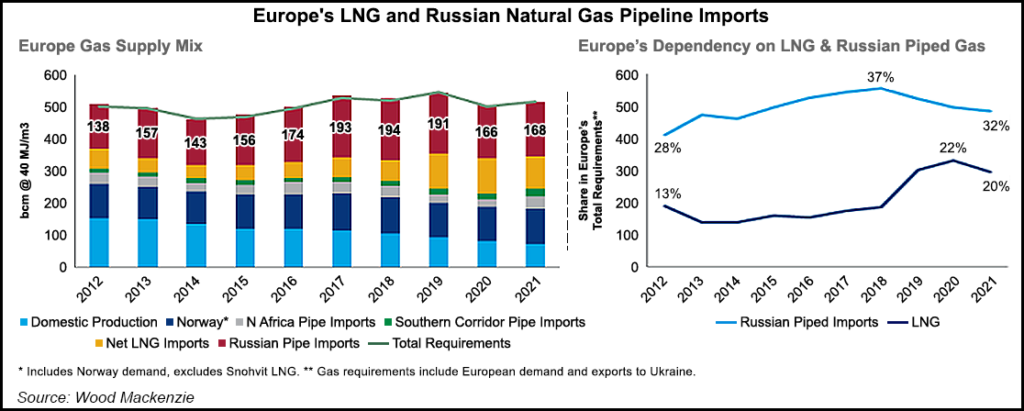

The European Commission (EC) announced a plan last week to reduce demand for Russian natural gas by two-thirds by the end of this year and gain independence by 2030. The proposal also calls for increasing liquefied natural gas (LNG) imports by 50 Bcm in 2022.

Norwegian-based Equinor also noted that the Hammerfest LNG export terminal in Norway is scheduled to come back online in May after repairs were needed following a fire at the facility in 2020. The plant would add another 6 Bcm/year of natural gas to the global market once it returns to service.

Europe is looking to break free of Russian natural gas as the conflict in Ukraine has trained a spotlight on its reliance on foreign fossil fuels. Russia accounted for 45% of Europe’s natural gas imports last year. Norway is the continent’s second largest pipeline gas supplier. About 23% of Europe’s natural gas came from Norway last year, according to the EC.

Russian exports into Western Europe dropped 9% day/day on Thursday, according to Rystad Energy. Warmer weather has curbed buying on the continent.

Despite a drop in demand and above-normal forecasts, the April Title Transfer Facility contract gained nearly $1 to finish above $34/MMBtu Thursday. The benchmark hit its lowest point this month on Wednesday. The war in Ukraine continues to factor heavily into price swings as negotiations and fighting continue.

“We expect the market would need to see a concrete reduction in hostilities before allowing a sharp downward price correction,” Rystad analysts said in a note.

The continent saw its first net injections since the end of 2021 last weekend, but storage inventories currently stand at 26% and remain below the five-year average of 36%.

Higher output from Norway over the summer could help fill storage. Once it’s finalized, part of Europe’s plan to wean off Russian natural gas calls for filling storage to 90% of capacity by October of each year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |