Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Crucial Russian Natural Gas Pipelines Eyed as European Prices Hit Fresh Record

Russian natural gas pipeline flows to Europe remain at some of their strongest levels in months despite fighting in Ukraine, but the market is on edge about any potential disruption in deliveries given how crucial imports are for the continent, which has helped to send natural gas prices soaring.

“A complete shutdown of Nord Stream 1 (NS1), Yamal-Europe and the Ukraine routes has devastating consequences for the European gas market, with knock-on effects around the world,” according to a recent Oxford Institute for Energy Studies (OIES) report. OIES said Friday that if flows were cut on those systems, Europe’s ability to refill its depleted storage capacity would be “severely compromised.”

Nord Stream AG, a joint venture of four European energy companies and Russia’s Gazprom PJSC, and operator of NS1, said on Friday that service continues as normal. “The transportation of natural gas to Europe via our pipeline system is currently continuing in the normal course,” Nord Stream AG said. “The full transportation capacity is available to the shipper”

The company added that it is not involved in the Nord Stream 2 (NS2) project and not engaged in the activities of Nord Stream 2 AG.

“Nord Stream AG is, therefore, not targeted by the sanctions against Nord Stream 2 AG,” or “by any other sanctions,” Nord Stream AG said on Friday. “Consequently, Nord Stream AG is able to execute its payments and settlements.”

Gazprom said Thursday that it was shipping natural gas to Europe via Ukraine, and Russian flows to the continent have remained strong since fighting broke out on February 24. Deliveries via Ukraine accounted for 22% of the 168.7 billion cubic meters (Bcm) that Russia delivered to the wider European market, including Turkey, in 2021, according to the OIES.

Russia, the world’s largest pipeline gas exporter, has diversified its routes to Europe. It can move supplies to the continent via Belarus, the Baltic Sea, Poland and Turkey.

OIES noted that Gazprom would be hard hit if it were to cut off flows. The company’s latest financial results for 3Q2021 show that even when the export duty is subtracted, shipments beyond the former Soviet Union accounted for 70% of its total sales revenues.

Continued fighting, the prospect of a cut in Russian supplies and the threat of further sanctions against Russia’s energy exports, has created even more volatility in the market. The prompt Dutch Title Transfer Facility contract surged to a new intraday high Thursday of more than $68/MMBtu. The climb in Europe has sent spot prices in North Asia to records as well. The Japan-Korea Marker was assessed at a new high of $59.672 on Thursday as the region is seen likely to continue competing aggressively for liquefied natural gas (LNG) cargoes.

NS1, which runs parallel to the now suspended NS2 system under the Baltic Sea, and Ukraine, are two of the four main pipeline routes delivering gas from Russia. The third is the Yamal-Europe pipeline to Germany, which delivered 26.5 Bcm last year. The other major line is TurkStream, which delivered 12.1 Bcm to European Union members in Southeast Europe last year.

NS1 delivered the largest volume of Russian gas to Europe in 2021 with over 59 Bcm received. Two parallel 750-mile pipelines run from Portovaya Bay, near Vyborg on the Russian coast, to Lubmin, Germany, to make up NS1. The project started gas deliveries in 2011.

NS2 would have sent even more gas from Russia to Germany. The 764-mile, 55 Bcm system is complete, but needs the approval of Germany and the EU to start-up. Germany suspended the project as part of an early package of sanctions that have made it difficult for the company operating the project to continue doing business.

The pipeline was seen as a key passage for more Russian gas to reach the continent as supplies there have been short since last year. The NS2 operator has terminated its workforce and is reportedly nearing insolvency.

Polish Prime Minister Mateusz Morawiecki requested one of the NS1 shareholders, German utility E.ON SE, to shut down the pipeline.

“E.ON holds a 15.5% minority share in Nord Stream 1. This stake is a historical and not a strategic participation. It is also not part of our operational asset base, but one element in our pension trust’s investment portfolio,” E.ON spokesman Leif Erichsen told NGI.

“The 100 Bcm or so of lost imports from the closure of Nord Stream 1, Yamal-Europe and the Ukraine pipeline routes would not easily be replaced with additional production in Europe or pipeline and LNG imports from elsewhere as the capacity does not exist.” OIES said.

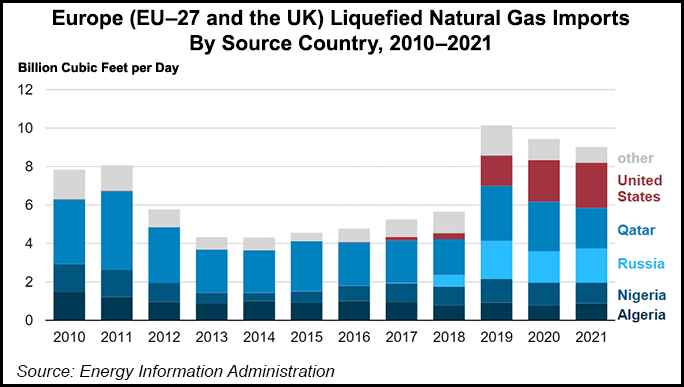

While deliveries have remained strong given price premiums on the continent, there are already issues emerging with Russian LNG deliveries to Europe. “The United Kingdom has banned Russian flagged, owned, chartered and operated vessels, while Lithuania has announced they will turn away Russian LNG,” Rystad Energy analyst Kaushal Ramesh told NGI.

“In the near-term, there’s risk from other EU countries doing the same and in an extreme scenario, this could rearrange LNG flows with Russian LNG going only to a few ports and LNG from elsewhere filling the gap,” Ramesh said. “This risk rises every day that Russia continues the offensive in Ukraine.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |