Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

Natural Gas Storage Stocks Move Above Year-Ago Levels After EIA Reports 92 Bcf Build

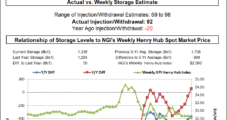

The Energy Information Administration (EIA) reported a 92 Bcf injection into U.S. natural gas storage for the week ending April 19, pushing inventories to a 55 Bcf surplus over year-ago levels.

NGI The Weekly Gas Market Report

Natural Gas Forwards Slide as Mild Spring Gives Storage Refill Season an Early Boost

Despite prospects for brief upswings in natural gas demand, an overwhelming bearish sentiment continued to weigh on forward prices this week as recent mild spring temperatures throughout much of the country were seen lasting at least through the early part of May. May prices fell an average 7 cents from April 17-24, while June and the balance of summer strip (May-October) each lost an average 8 cents, according to NGI’s Forward Look.

Demand Additions Spark 5-Cent Rally for Natural Gas Futures; Cash Slides

Subtle changes in daily weather models finally caught the attention of traders as natural gas futures staged a rally on Thursday that pushed the prompt month back above $2.50 despite fresh storage data that reflected a year/year surplus in inventories. The May Nymex gas futures contract jumped 5.2 cents to settle at $2.514/MMBtu, while June climbed 4.8 cents to $2.548.

May Natural Gas Jumps 5 Cents as Traders Take Notice of Demand Additions in Forecasts

Subtle changes in daily weather models finally caught the attention of traders as natural gas futures staged a rally on Thursday that pushed the prompt month back above $2.50 despite fresh storage data that reflected a year/year surplus in inventories. The May Nymex gas futures contract jumped 5.2 cents to settle at $2.514/MMBtu, while June climbed 4.8 cents to $2.548.

Natural Gas Futures Stall Ahead of Expected Flip to Surplus for Storage Stocks; Cash Bounces

Weather models continued to add back some demand for the next couple of weeks, driving natural gas futures marginally higher Wednesday as the market begins to move beyond a month-long period of massive year/year weather differences that were seen pushing storage inventories to a surplus over last year’s levels. The May Nymex gas futures contract settled seven-tenths of a cent higher at $2.462/MMBtu, while June rose 0.1 cents to $2.50.

Natural Gas Traders Eye Year/Year Surplus in EIA Data as Prices Stall; Cash Bounces

Weather models continued to add back some demand for the next couple of weeks, driving natural gas futures marginally higher Wednesday as the market begins to move beyond a month-long period of massive year/year weather differences that were seen pushing storage inventories to a surplus over last year’s levels. The May Nymex gas futures contract settled seven-tenths of a cent higher at $2.462/MMBtu, while June rose 0.1 cents to $2.50.

NGI The Weekly Gas Market Report

Summer Preview: South Central Region Sending Natural Gas Into Uncharted Waters This Injection Season

Perhaps more than ever, all eyes will be on the South Central region for natural gas markets this summer as robust associated production from oil wells and a projected doubling of natural gas exports will propel the market into uncharted waters. Factor in the need to refill historically low storage inventories and the potential for a major storm to hit the Gulf Coast, and the market is ripe for significant — though likely brief — price volatility.

Key Pipe Work Affects LNG Exports, Sending Natural Gas Futures Lower Despite Drop in Supply

One day after cooler trends in weather models helped boost natural gas futures by a few pennies, bears attempted to reclaim control by quickly reversing those gains amid shifting forecasts and a significant drop in flows to a Gulf Coast liquefied natural gas (LNG) facility. The May Nymex gas futures contract settled Tuesday at $2.455/MMBtu, down 6.9 cents. June lost 5.9 cents to hit $2.499.

Natural Gas Futures Reach Fresh Lows After Pipe Work Cuts Gas Flows to LNG Facility

One day after cooler trends in weather models helped boost natural gas futures by a few pennies, bears attempted to reclaim control by quickly reversing those gains amid shifting forecasts and a significant drop in flows to a Gulf Coast liquefied natural gas (LNG) facility. The May Nymex gas futures contract settled Tuesday at $2.455/MMBtu, down 6.9 cents. June lost 5.9 cents to hit $2.499.

Natural Gas Futures Poised for Rebound After Falling Under $2.50; Cash Slides

In a move that could be considered risky given the long Easter holiday weekend, natural gas traders continued to grind futures prices lower on Thursday, pushing the prompt month to a multi-year low. The May Nymex gas futures contract settled at $2.49, down 2.7 cents on the day. June slipped 2.4 cents to $2.535.