NGI The Weekly Gas Market Report | E&P | Infrastructure | LNG | Markets | Mexico | NGI All News Access

Summer Preview: South Central Region Sending Natural Gas Into Uncharted Waters This Injection Season

Perhaps more than ever, all eyes will be on the South Central region for natural gas markets this summer as robust associated production from oil wells and a projected doubling of natural gas exports will propel the market into uncharted waters. Factor in the need to refill historically low storage inventories and the potential for a major storm to hit the Gulf Coast, and the market is ripe for significant — though likely brief — price volatility.

After an early start to the winter season that left inventories more than 700 Bcf below historical levels in December, a jittery market sent prompt-month gas prices screaming to well above $4. What followed, however, was a return to more normal winter conditions and even milder weather as the season progressed. Lower 48 storage exited March at just above 1.1 Tcf, the lowest level since 2014, according to the Energy Information Administration (EIA).

Despite the significant shortfall in stocks, analysts expect to see a fundamental oversupply rapidly erasing deficits. During a webinar earlier this month to discuss the firm’s fundamentals outlook for the summer, Genscape Inc. analyst Eric Fell projected Lower 48 storage to end October at 3.79 Tcf, about 600 Bcf ahead of last year’s stocks. That comes out to about 3.8 Bcf/d higher injections summer/summer.

“That’s being driven by our supply growth expectations outpacing growth in exports, and our call for an outright decline in demand domestically, with power demand and residential/commercial declining by about 1.5 Bcf/d,” that would be offset partially by a 0.5 Bcf/d increase in industrial demand, Fell said.

In terms of weather-driven gas demand, this summer may have a difficult time living up to last year.

“Looking back at the last 12 months, weather has been exceptionally bullish from a degree day total perspective,” Fell said. “Ten out of the last 12 months have been bullish relative to the 30-year normal in terms of total degree days, and this has added around 600 Bcf to total demand versus normal over the last year — about 200 Bcf this past winter and about 400 Bcf last summer.”

Last summer was “wildly bullish” in terms of weather, including a historically cold April 2018 and an October 2018 that delivered both above-normal heating degree day and cooling degree day totals, he said. The exceptional cold last April means Summer 2019 will likely see about 0.5 Bcf/d less residential/commercial demand compared with last year.

Looking at power demand, the bullish weather last summer accounted for an additional 1.7 Bcf/d of burn versus normal, according to Genscape.

“That is the single largest driver in our current projection, in which we’re calling for a decline in summer power demand by an average of about 1 Bcf/d versus last year,” Fell said.

After factoring in changes in capacity, Genscape expects a roughly 12 average GWh decline summer/summer in thermal generation, a total that would be divided between gas and coal. Gas is expected to see its percentage of total thermal generation climb year/year to about 59%, versus about 58% last summer, continuing an ongoing trend driven by structural changes in the power stack.

The “demand curve” for natural gas in the power stack has been “shifting higher over time,” Fell said, with gas making up a larger percentage of total thermal generation at a given price.

Early forecasts have pointed to a below-average Atlantic Basin hurricane season in 2019, but a major storm crashing into the Gulf Coast or Southeast could have significant implications as liquefied natural gas (LNG) tankers traversing the coastline make up a larger chunk of U.S. demand.

U.S. LNG export capacity is set to more than double this year with more than 4 Bcf/d likely to begin commercial operation, with the lion’s share on the Gulf Coast. Last summer, only Dominion Energy Cove Point (in Maryland) and trains 1-4 at Cheniere Energy Inc.’s Sabine Pass, LA, export facility were in operation, consuming an average 3.2 Bcf/d in feed gas deliveries.

This summer, Cheniere has five trains operating at Sabine Pass, plus one at its Corpus Christi terminal and another set to enter service by the end of summer. Kinder Morgan Inc. earlier this month indicated that the first of 10 trains at its Elba Island project in Georgia would start up by May 1, while Sempra Energy’s Cameron LNG export project in Louisiana is in the commissioning phase and eyeing a 2Q2019 start-up. Freeport LNG in Texas has also been approved to introduce feed gas, portending start up sometime this summer.

The slate of start ups could see feed gas deliveries surpass 7 Bcf/d this summer, a substantial concentration of gas demand for an area prone to hurricanes. Taking such a significant chunk of demand out of the market even temporarily could wreak havoc on prices.

When heavy fog hit the Gulf Coast in early February, feed gas deliveries to Sabine Pass dropped to only 700 MMcf/d. Prices didn’t move noticeably, however, because winter demand likely muted any market response, according to BTU Analytics’ Matthew Hoza, energy analysis manager.

“If that had occurred during the summer, we would have likely seen more drastic price movements as overall demand levels are lower” and displaced LNG feed gas would have to find a new demand market.

While 2018 was a quiet year for storms, Hurricane Harvey that walloped the Gulf Coast in August 2017 is still fresh on the minds of management that had developments in operation or under construction at the time the storm hit. The slow-moving storm was the first major hurricane to make landfall in the United States since Wilma in 2005.

In a four-day period, Harvey dumped more than 40 inches of rain on areas as the system, which reached Category 4 status ahead of its initial landfall in San Jose Island, TX, slowly meandered over the Gulf Coast region, causing unprecedented flooding. Altogether, Harvey made five landfalls, the last in Louisiana on Aug. 29, as it traversed the coastline and veered into the Gulf of Mexico before drifting inland.

“For Harvey, the outer bands started hitting the Gulf Coast on Aug. 24, but we didn’t see any impacts to natural gas deliveries to Sabine Pass for another week. The facility operated normally until Aug. 30 as LNG storage tanks started to fill and feed gas deliveries began to fall,” Hoza said.

At its weakest, deliveries fell to only 170 MMcf/d, down 92% from a 30-day average prior to the storm hitting, according to Hoza. From a vessel perspective, Sabine Pass went 14 days (Aug. 24-Sept. 8) without lifting a cargo, compared to the average time of two days between cargoes for the rest of 2017.

Cheniere continued to produce LNG throughout the storm even though ships could not enter the Sabine Pass channel as so much water had accumulated, according to spokesman Eben Burnham-Synder. “We even used our tug boats to measure channel flows in order to understand when the channel was safe to traverse again because many of the sensors in the channel had broken.”

Altogether, Sabine Pass weathered little damage during Harvey, “cosmetic at best,” Burnham-Synder said. “Still, that’s not to say there weren’t some lessons learned. Harvey was an unfortunate test in many areas considering how destructive it was, but also informative in that it hit all of our facilities.”

Since the storm, Cheniere has set up an incident management framework with the goal of aligning with National Incident Management System and Federal Energy Management Agency standards. All of its LNG facilities are designed to withstand a direct hit and associated impacts from a Category 3 storm. The storm preparedness efforts vary depending on the stages of a storm, with management deciding to keep facilities fully staffed in a best-case scenario or implementing a hard shutdown in the worst case. Sabine Pass operated with a trimmed down crew, but with enough staff to safely operate the plant, according to Burnham-Snyder.

“It’s people first for us. We would never put people in harm’s way for a little extra bit of production. That’s not something we would ever do.”

Likewise, personnel safety is foremost for operators at Cameron LNG. The evacuation drill the terminal conducted early in the 2017 hurricane season was “paramount” to the success of the facility’s evacuation before Harvey hit. “Cameron LNG and its contractor evacuated approximately 6,000 people in less than 24 hours” although the facility itself was not impacted as the storm made landfall farther west, Cameron spokeswoman Anya McInnis said.

While the terminal’s storm preparations include provisions for 183 mph winds, heavy winds and storm tides or flooding, “the uncertainty of Mother Nature is the biggest challenge when you have a facility on the Gulf Coast,” McInnis said. The terminal uses Early Alert, a third-party weather and storm tracker, to monitor potential storms and also follows the same protocols utilized by the Cameron Parish Office of Emergency Preparedness.

And although designed to withstand hurricanes, there is the potential for site impacts because of severe weather, McInnis said. The facility’s emergency response plan, which details the processes and procedures to be undertaken before and during a severe weather emergency, is reviewed annually before hurricane season “to ensure that the plan is accurate and comprehensive.”

Notwithstanding the potential start-up delays that could impact the timeline for export growth, weak global economics could also eat into export volumes this summer, according to Genscape. Fell pointed to recent price declines in Asia, where a combination of a mild winter and global supply growth created slack in the market.

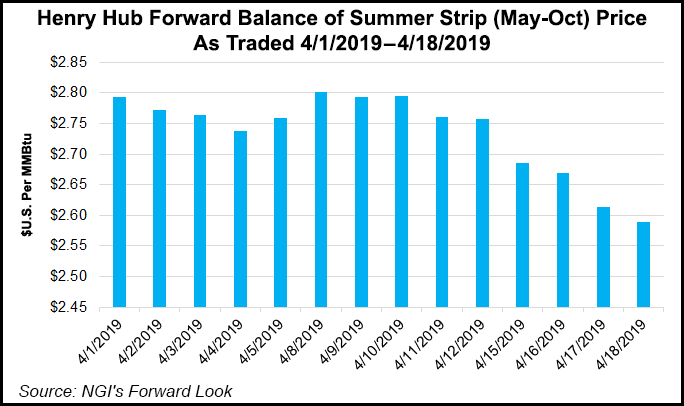

As of early April pricing, Genscape was still modeling “export facility utilization at levels comparable to what we’ve seen for the past two summers,” Fell said. “However, if global gas prices continue to fall and if those marginal economics begin to approach zero or even go negative, then we would make downward adjustments to our LNG export demand expectations.”

U.S. LNG may not be the only mechanism to balance the global market and ease a global oversupply, according to Fell. “There are a lot of wildcards with respect to global balances that could help clean up an oversupplied market.”

Nevertheless, U.S. LNG exports figure to continue reshaping South Central region storage dynamics during the summer injection season. Determining the exact impact of LNG dynamics on regional flows isn’t the easiest task, however, since much of the feed gas for the terminals is transported on intrastate pipelines in Texas, where data isn’t as readily available and transparent as it is for interstate pipelines.

“If there was robust demand in the form of exports and marginal industrial power, the facility may still be moving large volumes of gas, but it may not show up in weekly data,” BTU Analytics CEO Andrew Bradford said.

On the supply side, a glut of associated gas production from the Permian Basin has upended markets in West Texas, a development that could have storage implications for the South Central this summer.

An uptick in associated production, coinciding with maintenance-related pipeline restrictions that exacerbated an ongoing imbalance between supply and takeaway in the Permian, helped drive Waha spot prices deep into the negatives in late March and early April. NGI recorded trades as low as negative $9.000, meaning “sellers” were paying dearly to get gas past the region’s bottlenecks.

Following a bearish miss in EIA data for the week ended March 29, NGI’s Patrick Rau, director of strategy and research, noted that the South Central build for the period coincided with the severe negative pricing at locations including Waha.

Should depressed West Texas prices persist, which is a distinct possibility considering major new gas takeaway capacity out of the Permian isn’t expected until October when Kinder Morgan’s Gulf Coast Express is slated for service, negative gas prices could disrupt traditional storage models.

“My guess is that most storage estimates are based on a combination of pipeline flows and fundamental data,” Rau said. But the “vastly negative Permian prices” observed recently “are not based on natural gas fundamentals and therefore may not be fully picked up by storage models. Depressed Permian natural gas prices may persist for months. Therefore, unless forecasters make adjustments to their models, weekly consensus storage estimates may continue to be too low, leading to bearish surprises each Thursday morning.”

EIA data on April 18 reflected a hefty 48 Bcf build in the South Central that was only 1 Bcf shy of the all-time build. The larger-than-expected injection lifted inventories in the region to 571 Bcf, 6% below year-ago levels.

The recent price weakness in the Permian highlights the potential for increasing favorable crude oil economics to drive associated output, creating a potential inverse relationship between crude and gas prices.

Plays driven or heavily influenced by liquids pricing are making up a larger share of U.S. production, according to Genscape, which projected a 6.8 Bcf/d summer/summer increase in Lower 48 dry gas output. That’s a slower growth rate compared with last summer, which saw 9.6 Bcf/d of growth year/year. But that’s “still the second largest growth rate we’ve seen from a summer-on-summer, or year-on-year perspective, ever,” Fell said.

The constraints and weak pricing in the Permian create potential downside for Genscape’s output projections, which have become increasingly tied to the economics of liquids-focused plays.

“Oil prices are having a massive impact on our forward gas balances, bigger than we’ve ever seen before as the amount of production in the mix that is driven either mostly by oil or at least heavily impacted by liquids prices is bigger than ever,” Fell said.

The extent to which demand growth from some combination of power burns, LNG feed gas and incremental pipeline exports to Mexico, can limit market looseness this summer will be “heavily dependent on how much organic growth we see in output as the market enters peak cooling season,” according to Energy Aspects.

The Permian is not where the firm’s analysts are looking for fundamental tightening during the injection season. “For some time now, we have underscored how periods of maintenance, especially in the shoulder season, are likely to result in negative pricing at the hub,” Energy Aspects said. The extreme negative pricing observed recently “is indicative not only of how full all routes out of the region are, but of how even a relatively minor amount of off-lined capacity can easily exacerbate congestion issues given how close to capacity” the north-bound, west-bound and east-bound pipeline corridors have been running.

The firm estimated that even full utilization of the combined-cycle plants in the region would only generate up to 0.4 Bcf/d of demand under peak cooling load conditions.

In a recent note, RBN Energy LLC analyst Jason Ferguson highlighted power producers as one of the potential “winners” of the negative pricing situation in West Texas. RBN counted eight gas-powered plants in the Permian that, if all operated at full capacity simultaneously, could burn a little more than 900 MMcf/d. This is a “theoretical maximum” given that plants don’t generally run at full capacity for extended periods.

Permian power burn reached a record in the summer of 2018 at just above 550 MMcf/d, according to RBN. “While far below the theoretical maximum 900 MMcf/d we calculated, that level was more than 30% higher than the peak set during the summer of 2017,” Ferguson said. “The gains came amid significantly weaker Permian gas prices during 2018. Full-year 2018 power burns in the Permian averaged just over 450 MMcf/d, versus about 320 MMcf/d in 2017.”

The power burn trends over the last few years make it clear that “Permian gas burn has been reacting predictably to lower prices,” he said. But the question remains whether higher power burns, capped at that 900 MMcf/d theoretical maximum, provide enough demand upside to soak up excess supply and keep Permian prices from dropping deep into the negatives this summer.

“In our view, more Permian power burn records will be set this summer, but the gains are unlikely to be enough to eliminate the possibility of negative prices in the spot market during injection season, particularly during maintenance events or if Mexico exports don’t increase,” Ferguson said.

As a result, the Permian will become increasingly reliant on storage injections, according to RBN. The firm estimated that Permian gas storage facilities exited winter at historically low levels, but they have been “aggressively injecting” as of mid-April at a rate of around 400 MMcf/d.

As for the prospect of near-term Mexico export capacity out of the Permian, Energy Aspects analyst team expressed a bearish view.

“Our view on incremental relief from the Wahalajara pipeline is fairly negative, and we think it is highly likely that delays could push back additions to the system until after the injection season,” the firm said. “Meanwhile, we expect the next leg up in oil output to take hold in late 2Q2019 based on new takeaway and fracture crew increases.”

Prior to the start-up of Gulf Coast Express, Genscape is modeling for incremental gains in Permian exports to Mexico during the May to August time frame tied to the completion of the country’s La Laguna-Aquacalientes and Villa de Reyes-Aquacalientes-Guadalajara projects.

“Once those are completed, they’ll be the final parts of a long string of projects” that would enable 1 Bcf/d or more of Permian gas to flow into central Mexico, “which in turn should enable the displacement of LNG volumes, most of them flowing into Manzanillo, as well as the displacement of molecules flowing into central Mexico from South Texas,” Fell said. But this “depends heavily on these projects getting completed. These things have been delayed by two years, and at this point it’s really not an infrastructure or construction delay.”

With delays on legal or political risks, it’s more difficult to project the timeline for starting up these projects, according to Fell.

While not likely to relieve Permian constraints, the highly anticipated 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline might be the most visible of the oft-delayed Mexican pipeline projects that could present upside for pipeline exports south of the border this summer. An industry source told NGI earlier this month that the project might not begin operations until June.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |