Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

NGI The Weekly Gas Market Report

Surprise Shift to Record July Heat Sends Natural Gas Forwards Surging; Market Eyeing Barry

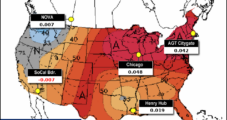

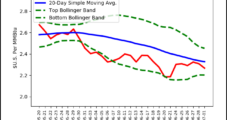

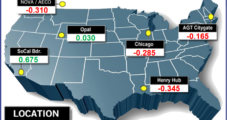

While fireworks lit up the night sky on the July Fourth holiday, natural gas forward prices put on a show of their own as an abrupt change in weather forecasts led to a huge rally during the July 3-10 week. August prices jumped an average 16 cents, with equally stout increases seen through the remainder of the year, according to NGI’s Forward Look.The surprise shift in long-range weather outlooks was just what market bulls had hoped for after mostly mild weather so far this summer has resulted in a rapid refill in storage inventories at the same time that production growth has accelerated. The latest weather outlooks were a little mixed as Tropical Storm Barry headed toward the Gulf Coast, bringing an expected drop in demand as heavy rains drench the region.In a 1 p.m. CT update, the National Hurricane Center (NHC) said Barry was moving toward the west near 5 mph, and this motion was expected to continue Thursday. A turn toward the west-northwest was expected Thursday night, followed by a turn toward the northwest on Friday. On the forecast track, the center of Barry was expected to be near the central or southeastern coast of Louisiana Friday night or Saturday.Maximum sustained winds were near 40 mph with higher gusts, according to the NHC. Strengthening was expected during the next day or two, and Barry could become a hurricane late Friday or early Saturday, it said.The slow movement of this system is expected to result in a long duration heavy rainfall threat along the central Gulf Coast and inland through the lower Mississippi Valley through the weekend and potentially into early next week, according to the NHC.Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.Heat Boosts AppalachiaHefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

Federal Regulators Issue Stern Warning to Cheniere Over Shuttered Storage Tanks

Federal regulators, unsatisfied with Cheniere Energy Inc.’s progress in completing a list of corrective measures following the mandated shutdown of two liquefied natural gas (LNG) storage tanks in early 2018, told the leading U.S. exporter that neither tank would be allowed to return to service until the previously agreed upon actions were completed.

Montage Cites Weak Commodity Prices as Appalachia Activity Scaled Back

Sticking to its commitment to a disciplined growth strategy, newly formed Appalachia-focused Montage Resources Corp. plans to scale back its drilling program amid expected lower commodity prices for the second half of 2019.

NGI The Weekly Gas Market Report

Cheniere Achieves First Production at Corpus Christi Train 2

Cheniere Energy Inc. continues to dominate the U.S. liquefied natural gas (LNG) export market, completing the first commissioning cargo from the second train at the Corpus Christi LNG terminal in South Texas.

NGI The Weekly Gas Market Report

Cooler July Outlooks Leave Natural Gas Forwards Sharply Lower; Bulls Running Out of Hope

There weren’t enough sparklers and bottle rockets to ignite natural gas forward prices for the June 27-July 2 period as cooler long-range weather forecasts doused any hopes for an extension of last week’s gains.

NGI The Weekly Gas Market Report

[Article Headline]

The oil and natural gas midstream sector offers attractive opportunities as production is set to continue growing, particularly in the Permian Basin, even as exploration and production (E&P) capital spending is expected to fall as much as 5% in 2019, according to Moody’s Investors Service Inc.The slowdown in spending comes as oil and gas production companies continue to reassess their capital budgets while balancing shareholder demands for share buybacks and higher dividends, Moody’s said in its latest Global Midstream Outlook. “We expect that E&P capital spending will fall by 3-5% in 2019 after two consecutive years of strong growth.”Yet production growth will remain robust and jump again by 8-12% in 2019, with volumes increasing in most North American basins, including the Permian, South Central Oklahoma Oil Province/Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (aka SCOOP/STACK), the Western Canadian Sedimentary and Appalachia, the firm said.Steeper cuts are seen in the midstream sector, where new projects will slow as spending is set to decline by 15-20% in 2019 and 2020 as companies focus on completing large existing projects and delivering earnings growth to help strengthen their credit quality, according to Moody’s.Additional project completions will address existing shortages in transportation capacity, and will pick up volumes, based on E&P investments already made, the investment firm said. But a greater focus on balance-sheet strength by midstream companies and investors, rising regulatory scrutiny and increasing difficulties in gaining social license to build large projects such as interstate pipelines will all contribute to the slowing pace of midstream investment.Nevertheless, the midstream sector offers an attractive medium-term growth opportunity.“Rising U.S. production of oil, natural gas and natural gas liquids (NGL) will require additional infrastructure to support exports of products and to open new markets for U.S. producers, including connecting the key producing basins to the export centers of the Gulf Coast,” Moody’s said.Indeed, Plains All-American Pipeline is nearing completion of its 300,000 b/d Cactus II oil pipeline connecting West Texas Permian crude and condensate output to the Port of Corpus Christi on the Texas coast. The system, which is comprised of existing pipelines and two new pipelines, is scheduled to enter service in the third quarter.The first new pipeline would extend from Wink South to McCamey in Upton County. The second new pipeline would extend to the southeast from McCamey to the area of Corpus Christi and Ingleside.Plains is also a partner in the Red Oak Pipeline system, a 50/50 joint venture with Phillips 66 to provide crude transportation service from Cushing, OK, and the West Texas Permian to the Texas coastal cities of Corpus, Ingleside, Houston and Beaumont.“The pipeline provides a competitive outlet for shippers to access the key market centers along the Texas Gulf Coast from Cushing and the Permian,” Phillips 66 CEO Greg Garland said. “This investment aligns with our long-term strategy to grow our midstream business with projects generating stable, fee-based earnings while further enhancing integration across our value chain.”With such a heavy focus on the Permian, where production in West Texas and southeastern New Mexico drove Gulf Coast growth to 7.1 million b/d in 2018 versus 5.2 million b/d in 2014, the basin’s shortfall in transportation capacity has restricted growth there in 2018-19, according to Moody’s. Furthermore, the lack of takeaway capacity has forced producers to manage significant price discounts that reduce their returns on investment, and in turn, slow growth in production.“Oil pipelines going into service in the 2H2019 will alleviate the oil bottleneck and spur further oil production and production of the associated natural gas, thereby aggravating the shortfall in natural gas takeaway capacity,” Moody’s said.However, some relief is expected on the gas side later this year when Kinder Morgan Inc.’s Gulf Coast Express enters service. A year later, KMI’s Permian Highway Pipeline (PHP) is set to begin commercial operations, and the recently sanctioned Whistler pipeline is set for a 3Q2021 in-service.In late June Summit Midstream Partners LP opted to move forward with the 1.35 Bcf/d Double E pipeline project after securing “sufficient” binding commitments for long-term, firm transportation service. The system is designed to move natural gas from the Permian’s Delaware sub-basin to the Waha hub and beyond. The target in-service date was set at 2Q2021, pending regulatory approvals.“As takeaway capacity comes on stream, wide natural gas basis differentials will also likely ease by late 2020 to levels closer to the transportation costs at established market hubs,” Moody’s said.Meanwhile, the rapid growth in NGL production offers further growth opportunities for midstream companies, particularly in the SCOOP/STACK and Permian, according to the firm. It sees midstream companies making significant investments in additional fractionation capacity at major NGL hub Mont Belvieu.Momentum in midstream growth will depend on the availability of capital, the investment firm said. “The midstream energy sector today is transforming its growth-orientated business model.”Structural simplifications and resets of costly incentive distribution rights to general partners are making the midstream business model more investor-friendly, according to Moody’s. Companies are increasingly striving to finance new projects with their own cash flow, rather than first distributing cash flow to investors, only to later depend on the capital markets for funding.However, the high cost of equity capital required to fund growth projects is squeezing the master limited partnership (MLP) organizational structure, especially as increasing competition for new projects from private capital reduces project returns. “MLPs are taking different approaches to help improve their weak distribution coverage or relieve high debt leverage,” Moody’s said.The low valuations of midstream companies compared to refining or stronger E&P companies have also largely reduced the financial benefits of using a sponsored MLP structure to raise funding for a sponsor’s new investment projects or share repurchases.Valero Energy repurchased the remaining stake of its sponsored Valero Refining MLP in 1Q2019 and consolidated the subsidiary to begin raising capital on a centralized basis. Other MLP sponsors such as EQT Corp. and Antero Resources divested their sponsored midstream operations, including essential supporting infrastructure, to attract new capital and reinvest proceeds in the development of core operations.Moody’s expects private equity groups to remain the driving force behind consolidation and mergers and acquisitions activity among the smaller midstream companies, with deals likely to percolate during 2019-20. “The trend is particularly visible in the highly competitive and fragmented Permian segment, where smaller gathering and processing companies, often backed by private equity, still struggle to keep pace with the growth in production.”The investment firm expects to see more ambitious deal making among smaller operators in 2019-20, such as BCP Raptor Holdco’s investment in the KMI-led PHP.“Such equity-backed acquisitions have broadly supported credit quality to date for midstream companies that aim to accelerate project completions and to scale up and bring additional volumes to their systems to add to earnings growth,” Moody’s said.Still, private equity investors will actively participate in funding new growth projects, including with large midstream companies, according to the firm. Meanwhile, relatively low valuations and improving cash flow generation and leverage can make midstream companies more attractive for takeovers, as with Australian private infrastructure investment firm IFM Investors’ recent all-cash acquisition of Buckeye Partners LP.

Natural Gas Futures End Week on Soft Note as Weather Outlooks Trim Demand; Increased Exports to Mexico in Limbo

After a solid run following supportive storage data, natural gas futures prices fluctuated in and out of positive territory Friday as traders digested slightly cooler long-range weather outlooks. The August Nymex gas futures contract rose as much as $2.364 before going on to settle at $2.308, down 1.6 cents on the day. September also slipped 1.6 cents to $2.282.

July Natural Gas Rises on Near-Term Heat; Futures Set for Declines as Outlooks Trend Cooler

Driven by increasingly warmer weather outlooks that have since trended cooler for later this month, natural gas forward prices posted nearly 10-cent gains across the front of the curve for the June 20-26 period, according to NGI’s Forward Look.

Easing Heat, Stout Supplies Pressure July NatGas Bidweek Prices; Futures Remain Near Lows

Despite scorching temperatures in store for the first week of July, a cooler long-term outlook squashed any hopes for a rally for natural gas bidweek prices, which posted steep 20- to 30-cent losses at the majority of market hubs. Hefty gains out West were no match for the overall weakness seen across the rest of the country, with the NGI July bidweek National Avg. tumbling 12.5 cents to $1.980.

Cooler Changes to Long-Term Forecasts Send Natural Gas Futures Lower; Cash Up on Current Heat

After a solid run following supportive storage data, natural gas futures prices fluctuated in and out of positive territory Friday as traders digested slightly cooler long-range weather outlooks. The August Nymex gas futures contract rose as much as $2.364 before going on to settle at $2.308, down 1.6 cents on the day. September also slipped 1.6 cents to $2.282.