Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

Natural Gas Futures See More Extreme Swings; Waha Bounces Back

One day after an oil market tailspin sent natural gas futures exploding higher, May natural gas stopped to catch their breath before going on to nosedive.

‘Roller Coaster’ Continues at Full Speed for Natural Gas Futures; Permian Cash Gains Again

Early selling in natural gas futures failed to hold, with erratic, non-fundamentally driven price fluctuations continuing midweek. After sinking to a $1.774 intraday low, the May Nymex gas futures contract settled Wednesday at $1.939, up 11.8 cents on the day. Increases continued throughout the curve, with June picking up 6.9 cents to hit $2.053.

Oil Market Turmoil Sends Natural Gas Futures Blasting Higher, but Permian Cash Falls to New Low

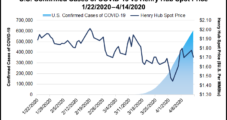

Still struggling to get a grasp on how much demand is being lost amid the coronavirus pandemic, natural gas traders on Monday took their cue from unparalleled deterioration in the oil markets. After an initial sell-off early in the session, the May Nymex gas futures contract rallied, shattering resistance and settling the day at $1.924, up 17.1 cents from Friday’s close. June climbed 14.6 cents to $2.049.

Volatility Continues for Natural Gas; Futures Plunge 10 Cents, Waha Cash Rebounds

One day after an oil market tailspin sent natural gas futures exploding higher, May natural gas stopped to catch their breath before going on to nosedive.

Natural Gas Futures Extend Gains as Rigs Fall, Shut-In News Continues; Cash Bounces on Cold

Despite an increase in weather-driven demand expectations over the weekend, technical factors and broader bearishness across the energy sector helped keep the pressure on natural gas prices in early trading Monday. The May Nymex contract was down 2.6 cents to $1.727/MMBtu at around 8:30 a.m. ET.

Natural Gas Futures Surge as WTI Crude Goes Negative, but Waha Cash Trades at Record Low

Still struggling to get a grasp on how much demand is being lost amid the coronavirus pandemic, natural gas traders on Monday took their cue from unparalleled deterioration in the oil markets. After an initial sell-off early in the session, the May Nymex gas futures contract rallied, shattering resistance and settling the day at $1.924, up 17.1 cents from Friday’s close. June climbed 14.6 cents to $2.049.

Fast, Hard Production Cuts Spark Surge for Natural Gas Futures; Cash Prices Slip

Natural gas futures treaded water for much of Thursday, not even blinking when the latest storage data painted an increasingly bleak demand outlook. Instead, the rapid pace of falling production grabbed traders’ attention, while some short-covering also likely came into play. The May Nymex gas futures contract settled at $1.686, up 8.8 cents from Wednesday’s close. June shot up 9.7 cents to $1.845.

‘Obscenely Loose’ Balances Pressure Natural Gas Forwards; Production Cuts Boost Back of Curve

With the possibility of continued cold out the window, the fallout from coronavirus-related restrictions dominated natural gas forward markets for the April 8-15 period.

Buoyed by Rig Data and Supply Cuts, Natural Gas Futures Post More Gains to Close Week

Natural gas futures extended their rally to cap off a week in which the coronavirus pandemic continued to decimate demand and producers snatched more rigs off the field. The May Nymex gas futures contract settled Friday at $1.753, up 6.7 cents from Thursday’s close. June rose 5.8 cents to $1.903.

Springtime Cold Blast Ripples Through Weekly Spot Natural Gas Markets; West Falls With Hydro Season in Full Swing

Some back and forth in spot gas markets during the April 13-17 period ultimately ended with mostly lower prices for week/week as remnants of cold weather began to move out of the country. Despite some pockets of cold expected to linger the next couple of days, NGI’s Weekly Spot Gas National Avg. slipped 2.5 cents to $1.495.