NGI Weekly Gas Price Index | Markets | NGI All News Access

Springtime Cold Blast Ripples Through Weekly Spot Natural Gas Markets; West Falls With Hydro Season in Full Swing

Some back and forth in spot gas markets during the April 13-17 period ultimately ended with mostly lower prices for week/week as remnants of cold weather began to move out of the country. Despite some pockets of cold expected to linger the next couple of days, NGI’s Weekly Spot Gas National Avg. slipped 2.5 cents to $1.495.

Most notably in the red were spot markets out West, where overall power load is being “materially impacted” by Covid-19-related shutdowns and other restrictions, according to Mobius Risk Group. In addition, the West is entering peak hydroelectric generation season, which limits the ability for low natural gas prices to stimulate additional burn.

“Water running off the side of a mountain and through a hydro turbine is free, and this obviously impossible to compete with,” Houston-based Mobius said.

European ensemble weather models point to hotter temperatures later this month and into early May, which would bring some welcome cooling degree days, according to the firm, “but the typical spring headwind where production rebounds from the winter as hydro output increases is certainly in play.

“The counter to this could be a sharply reduced amount of supply if the expected crude production cuts in May materialize. Reduced oil output from the Permian Basin, Bakken Shale and Denver-Julesburg Basin would significantly soften the blow and potentially leave the West feeling rather tight.”

SoCal Citygate prices averaged $1.560 for April 13-17, down 32.5 cents week/week. Double-digit decreases extended into northern California.

Interestingly, markets upstream in the Permian managed to strengthen week to week, with Waha jumping 16.5 cents to average 27.0 cents. Other Texas points were lower.

Prices across Louisiana and the Southeast also softened, but losses were limited to less than a dime.

Most points farther east finished the week in the black as the blast of chilly air hit the region. Algonquin Citygate jumped 11.0 cents week/week to average $1.650.

Even at under $2/MMBtu, natural gas prices are not immune to volatility, and this week underscored the sensitivity of the market when non-fundamental drivers are in play.

After a three-day weekend, a major move for Nymex futures was to be expected given the chilly weather that blanketed much of the Lower 48 following the Easter weekend. The May contract surged early, surpassing $1.80 before midday, but then tumbled as widespread demand losses from coronavirus-related shutdowns took center stage. The prompt month ended the session nearly unchanged from April 9, the last day of trading in the prior week.

The $1.80 mark has been a stubborn level of resistance that natural gas has failed to hold since a near nationwide shutdown was implemented to slow the spread of Covid-19. Anytime a breach of the resistance level occurs, prices plunge. This occurred over the next two trading sessions as May prices fell back into the $1.50 range.

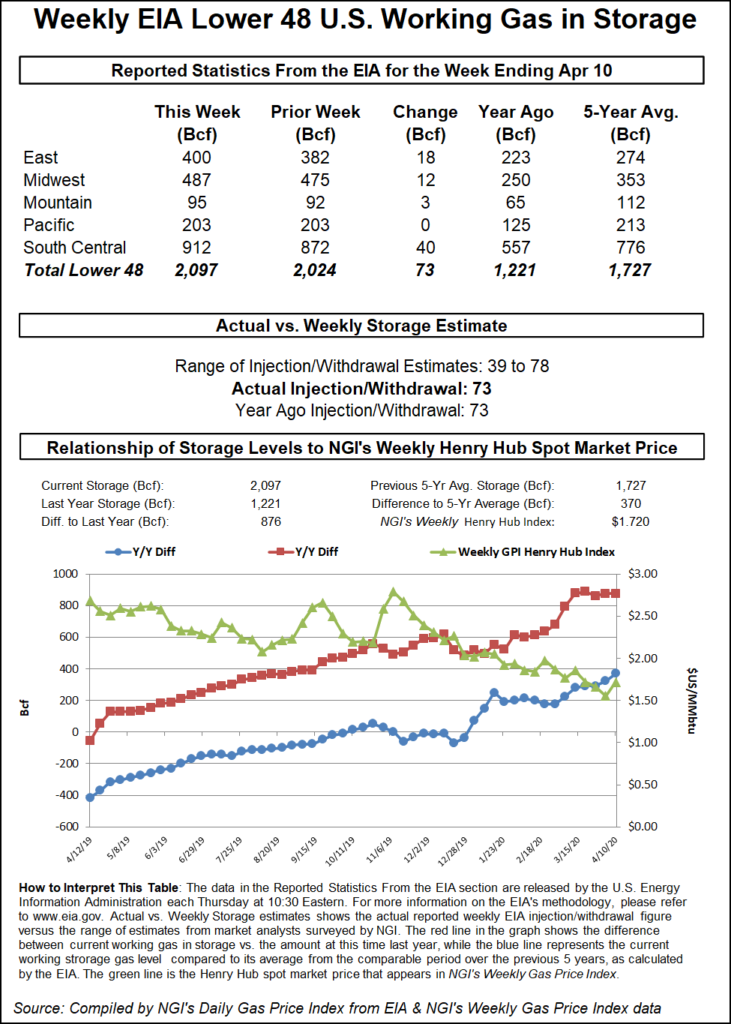

On Thursday, more losses seemed certain as the Energy Information Administration’s (EIA) latest storage report provided further indication of the massive demand destruction that has taken place since the Covid-19 restrictions were implemented. The EIA reported a 73 Bcf injection into storage inventories for the week ending April 10, a build that crushed the lowest estimates ahead of the report by a whopping 34 Bcf.

But Nymex futures didn’t even blink when the EIA print hit the screens. Instead, May bounced off the $1.555 intraday low and proceeded to surge more than 16 cents, ultimately settling Thursday at $1.686, up 8.8 cents day/day. June rose an even greater 9.7 cents to $1.845, with gains extending through 2021.

One explanation for the rally, at least pertaining to the balance of 2020, could be the unwinding of producer hedges as redeterminations begin to finalize, and/or the unwinding of gas hedges by oily producers who are planning significant cuts to their boe/d output beginning in May, Mobius said. Alternatively, the shape of the curve before Thursday’s move was such that a near-term rebound was likely, according to the firm.

“Wednesday’s close posted a summer/winter spread of minus 80 cents, which is more than enough to spur a wave of storage buying,” said Mobius.

Bespoke Weather Services said the move looked similar to previous instances when prompt-month prices dipped into the $1.50s, as they continue to find “solid technical support at those levels.” With a bullish curve structure, the prompt month “is able to take off.

Pointing out that such technically driven rallies typically last two to three days, Bespoke said it was possible the market continued to strengthen. Indeed, the May Nymex contract opened higher at the start of Friday’s session and rallied as high as $1.806 before going on to settle at $1.753, up 6.7 cents day/day.

But in order to sustain a rally, the market needs to see “material tightening” in balances, either by way of demand returning or by production falling more, according to Bespoke. “The latter is expected later this year, but as oil prices crater, there is risk of some declines in the nearer term as well.”

Liquefied natural gas (LNG) also is up in the air, the firm said. Although major declines have yet to be seen, that is still a risk moving into the next few months.

“All in all, we still see too many uncertainties in play to justify a big move from here. The market has declared $1.50s as too low but $1.80s too high, for now,” Bespoke said.

With cold weather hanging on for a bit longer, spot gas prices across most of the United States strengthened Friday. Lows in the 20s and 30s were forecast to “rule” the central and northern states through the early part of the week as cool shots sweep through for relatively strong late-season heating demand, according to NatGasWeather.

Recent data has been “a touch cooler” with a system over the Northeast early in the week, “but far from cold,” the firm said. Meanwhile, the southern part of the country is expected to warm back into the “near-ideal” 70s and 80s.

While the pattern is “just cold enough” through in the week, cold air is still expected to retreat into Canada after, “with highs of 50s to 70s returning to the Midwest and Northeast, including near 70 from Chicago to New York City, easing national demand to light levels,” NatGasWeather said.

For now, though, it was enough to support a bounce in cash in most markets across the Lower 48.

In the Northeast, Iroquois Zone 2 prices for gas delivered through Monday jumped 14.0 cents to $1.665. Columbia Gas in Appalachia was up 16.5 cents to $1.585.

The Midwest’s Chicago Citygate shot up 19.5 cents to $1.720 for the three-day gas delivery, while NGPL Midcontinent soared by some 16.0 cents to $1.375.

Benchmark Henry Hub cash rose 14.5 cents to $1.695, similar to gains seen across most of Texas.

The exception in the Lone Star State was in the western region, where cash prices came crashing down by more than 20 cents. Waha fell to a 17.0-cent average, with some transactions seen as low as zero.

Some losses also were seen on the West Coast, where SoCal Citygate prices for gas delivered through Monday slipped 7.5 cents to $1.440.

Southern California Gas (SoCalGas) on Thursday announced the final approval of a 40-year agreement with the Morongo Band of Mission Indians regarding two high-pressure lines that cross the Morongo Reservation near Cabazon, CA. This ensures that ample import capacity on SoCalGas’ Southern Zone will remain available, according to Genscape Inc.

The rights-of-way for Lines 5000 and 2001 are officially renewed under this agreement, which had been pending final approval by the Bureau of Indian Affairs for about 16 months but continued to flow in the interim.

Over in the Rockies, Rockies Express Pipeline (REX) was to begin planned pipeline work Saturday that could limit up to 154 MMcf/d of receipts in northern Colorado and potentially restrict eastbound flows through May 18, Genscape analyst Anthony Ferrara said. Various interstate interconnects, receipt points, and segments were to be restricted throughout the month-long maintenance in the Cheyenne area.

The work being performed will limit flows through SEG 200 to 1,700 MMcf/d from April 18 through May 2, and then to 1,383 MMcf/d from May 3 through May 12. “At current flow levels, neither of these restrictions will come into play as SEG 200 has only averaged 757 MMcf/d over the past 30 days,” Ferrara said.

Furthermore, receipts onto the pipeline could be restricted by up to 154 MMcf/d due to shut-ins at the “WIC Sitting Bull” location and the “CHEY Crazy Bear Weld” location.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |