Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

Natural Gas Futures Retreat as Bearish Backdrop Seen Persisting a Bit Longer; Cash Bounces

Natural gas futures bounced around a bit on Friday, but ultimately capped the week on a soft note despite some slight tightening in supply/demand balances. The June Nymex gas futures contract settled at $1.646, down 3.5 cents from Thursday’s close. July fell 5.1 cents to $1.833.

Big Surge for Natural Gas Futures as Production Drops Further; Cash Rallies Too

Natural gas futures raced higher Monday as supply/demand balances finally started to move in a more supportive direction for prices. With a further push from the cash market, the June Nymex gas futures contract settled up 13.7 cents from Friday’s close at $1.783. July jumped 12.6 cents to $1.959.

Natural Gas Futures Bounce Back Despite Otherwise Bearish Fundamentals

Technical trading sparked a rebound for natural gas futures on Thursday, with prices starting off the session several cents higher after plunging more than 20 cents the previous two days. With government storage data falling slightly short of expectations, the June Nymex gas contract climbed 6.5 cents to settle at $1.681. July rose 2.8 cents to $1.884.

Natural Gas Forwards Plunge as LNG Demand Sinks Underwater; AECO Losses Not as Steep

Faced with a massive decline in liquefied natural gas (LNG) demand and a slow reopening of the economy amid the coronavirus pandemic, natural gas forward prices collapsed during the May 7-13 period, NGI’s Forward Look data show.

Natural Gas Futures Slip in Choppy Trade; Cash Bounces Despite ‘Comfortable’ Weather Pattern

Natural gas futures bounced around a bit on Friday, but ultimately capped the week on a soft note despite some slight tightening in supply/demand balances. The June Nymex gas futures contract settled at $1.646, down 3.5 cents from Thursday’s close. July fell 5.1 cents to $1.833.

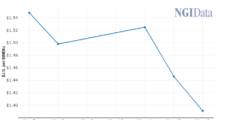

Springtime Temperatures Sap Demand, Send Weekly Spot Natural Gas Prices Sharply Lower

With the eastern United States thawing from an unusual winter blast over Mother’s Day weekend, and cloud cover keeping truly hot weather at bay in the South, spot gas prices for the May 11-15 period dropped by the double digits across the Lower 48. NGI’s Weekly Spot Gas National Avg. was down 23.0 cents to $1.520.

Technicals, Lower-Than-Expected Storage Build Fuel Recovery for Natural Gas Futures

Technical trading sparked a rebound for natural gas futures on Thursday, with prices starting off the session several cents higher after plunging more than 20 cents the previous two days. With government storage data falling slightly short of expectations, the June Nymex gas contract climbed 6.5 cents to settle at $1.681. July rose 2.8 cents to $1.884.

NGI The Weekly Gas Market Report

U.S. Midstreamers Prepped for Lower Volumes, but See ‘Variability’ in E&P Responses

Armed with major reductions in spending and a pause on some projects, Enable Midstream Partners LP, Targa Resources Corp. and DCP Midstream LP have joined companies up and down the energy supply chain in positioning themselves to emerge from the oil market decline and economic downturn on strong financial footing.

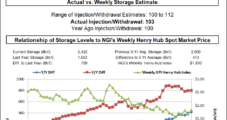

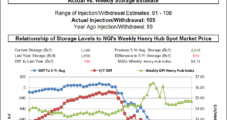

Natural Gas Futures Extend Earlier Rally After EIA Storage Build Falls Short of Consensus

The U.S. Energy Information Administration (EIA) reported a 103 Bcf injection into storage inventories for the week ending May 8, coming in slightly below consensus and providing some further uplift to natural gas futures, which had started off Thursday on slightly higher ground.

Natural Gas Futures Plunge as Softening LNG Demand, Hefty Storage Build Weigh on Market

Natural gas futures continued to pull back Wednesday as liquefied natural gas demand (LNG) took another hit. With government storage data expected to produce a second consecutive triple-digit injection, the June Nymex gas futures contract settled 10.4 cents lower at $1.616. July fell 10.9 cents to $1.856.