Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

Weather Drives Big Moves for Weekly Natural Gas Spot Prices

Spot natural gas prices came roaring back for the first week of May, driven higher by cooling demand from the West Coast to the Southeast and heating demand in the Midwest and East. An surge in futures early in the week also lent support to markets, with theNGIWeekly Spot GasNational Avg.rocketing some 20.5 cents higher to $1.750.

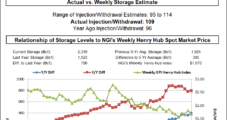

June Natural Gas Futures Stabilize After EIA Reports High Side, Triple-Digit Storage Build

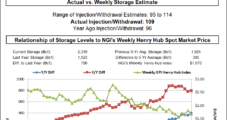

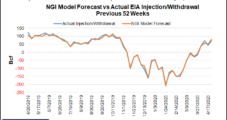

The U.S. Energy Information Administration (EIA) reported a 109 Bcf natural gas storage injection for the week ending May 1, on the high end of market estimates, but on the money with NGI’s projection.

Natural Gas Bears Pounce After Tetco Production Rerouted; Cash Retreats

In one fell swoop, natural gas futures on Wednesday erased all of the previous day’s gains resulting from a pipeline explosion on one of the Lower 48’s oldest natural gas pipelines. With much of the impacted production on that line being rerouted, the June Nymex gas futures contract plunged 19.0 cents to settle at $1.944. July tumbled 14.1 cents to $2.171.

NGI The Weekly Gas Market Report

Volatility Still Abounds, but Natural Gas Futures Start May on Steadier Foot

Despite erratic swings throughout the week, natural gas forward prices eventually stabilized as the calendar flipped to May as states across the country started to reopen amid the coronavirus pandemic. Despite ongoing uncertainty about continued economic recovery as well as liquefied natural gas (LNG) demand, June natural gas prices averaged only a penny lower for the April 30-May 6 period, according to NGI’s Forward Look.

Natural Gas Futures Fall as EIA Data Continues to Point to ‘Very Loose’ Balances

After some back and forth, bears prevailed in the battle for control of natural gas futures on Thursday as the first in an expected string of triple-digit storage injections was reported by the Energy Information Administration (EIA). The June natural gas neared the $2.00/MMBtu mark early, but then eventually settled 5.0 cents lower day/day at $1.894. July slipped 4.4 cents to $2.127.

Natural Gas Futures Surge as Tetco Explosion, Production Loss Fuel Bulls

Natural gas futures raced higher Tuesday as traders assessed overnight news of a pipeline explosion and the resulting drop in production. The June Nymex gas futures contract breezed past the $2/MMBtu mark to settle 14.1 cents higher day/day at $2.134. July jumped 8.2 cents to $2.312, while smaller gains were seen through October with modest losses beyond that.

Crestwood Banks on New NGL Assets, Leaner Structure in Driving 2020 Growth

Crestwood Equity Partners LP is offering incentive rates across its midstream portfolio in order to generate revenue, but management expects the natural gas liquids (NGL) storage and rail-to-truck liquid petroleum gas (LPG) terminal assets that it recently acquired to be the largest contributor to a projected 3% year/year increase in earnings this year.

Extensive Sell-Off for Natural Gas Futures as Tetco Production Largely Rerouted; Cash Slips Too

In one fell swoop, natural gas futures on Wednesday erased all of the previous day’s gains resulting from a pipeline explosion on one of the Lower 48’s oldest natural gas pipelines. With much of the impacted production on that line being rerouted, the June Nymex gas futures contract plunged 19.0 cents to settle at $1.944. July tumbled 14.1 cents to $2.171.

Natural Gas Futures Rebound as Production Declines, Demand Added to Weather Models

Coming off a mild winter, weather models that showed chilly weather lingering a bit longer aided a rebound for natural gas futures to start the week. Reinforced by a sustained drop in production that first showed up at the end of last week, the June Nymex gas futures contract climbed 10.3 cents to settle Monday at $1.993. July rose 9.6 cents to $2.230.

Tetco Explosion, More Production Cuts Send Natural Gas Futures Blasting Past $2/MMBtu

Natural gas futures raced higher Tuesday as traders assessed overnight news of a pipeline explosion and the resulting drop in production. The June Nymex gas futures contract breezed past the $2/MMBtu mark to settle 14.1 cents higher day/day at $2.134. July jumped 8.2 cents to $2.312, while smaller gains were seen through October with modest losses beyond that.