Kevin Dobbs joined the staff of NGI in April 2020. Prior to that, he worked as a financial reporter and editor for S&P Global Market Intelligence, covering financial companies and markets. Earlier in his career, he served as an enterprise reporter for the Des Moines Register. He has a bachelor's degree in English from South Dakota State University.

Archive / Author

SubscribeKevin Dobbs

Articles from Kevin Dobbs

Natural Gas Futures Fail to Find Momentum Amid Steady Production, Weak Demand

Natural gas futures traded in a narrow range most of Thursday, ultimately closing in the red following a government inventory report that reminded of the demand weakness that permeated the U.S. market through early 2023. The March Nymex gas futures contract settled at $2.389/MMBtu, down 8.2 cents day/day. April shed 7.0 cents to $2.485. NGI’s…

Natural Gas Futures Fizzle Following Modest Storage Pull; Cash Prices Mixed

Natural gas futures traded in a narrow range most of Thursday, ultimately closing in the red following a government inventory report that reminded of the demand weakness that permeated the U.S. market through early 2023. At A Glance: EIA prints 100 Bcf storage draw Production remains strong Demand outlook uncertain The March Nymex gas futures…

100 Bcf Storage Withdrawal Sends Natural Gas Futures Sideways

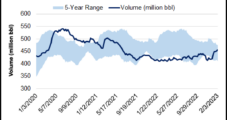

The U.S. Energy Information Administration (EIA) posted a pull of 100 Bcf natural gas from storage for the week ended Feb. 10, coming in close to expectations but below historical averages. The pull kept inventories comfortably above five-year average levels at a time when winter heating demand has proven relatively weak and production strong. Output…

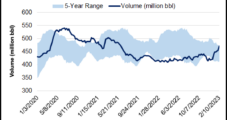

American Oil Producers Keep Output Elevated; IEA, OPEC Ramp Up Demand Forecasts

U.S. crude production held firm at a pandemic-era high as new forecasts called for rising global demand tied to an expected surge in Chinese travel fuel consumption. American producers generated 12.3 million b/d for the week ended Feb. 10, on par with the prior week and the high mark of the past nearly three years,…

U.S. Inflation Remains Elevated, but Pace Eases Amid Weaker Natural Gas Prices

U.S. inflation held at lofty levels but the pace of consumer cost increases edged lower in January, in part due to soft natural gas prices, extending a seven-month trend of easing expense pressure. The Labor Department’s Consumer Price Index increased 6.4% in January from a year earlier – more than three times the 2% level…

Foothills Exploration Acquires Oklahoma Natural Gas, Oil Wells

Foothills Exploration Inc. closed a deal to acquire a string of natural gas and oil wells in the Midcontinent region in a bid to capitalize on the enduring strength of demand for fossil fuels. The Los Angeles-based exploration and production (E&P) company said Monday it acquired 21 shallow oil and gas wells, all located in…

Atop Natural Gas Cuts, Russia Warns Oil Production Pullback Coming

Russia said it would cut its roughly 10 million b/d oil production by 5% in retribution of Western sanctions amid the Kremlin’s nearly year-long war in Ukraine. The decision follows steps by Russia in 2022 to slash the bulk of natural gas exported via pipeline to the European Union (EU) – moves that hastened calls…

Russia Vows Oil Production Cuts, Compounding Natural Gas Retaliation Against Europe

Russia said it would cut its roughly 10 million b/d oil production by 5% in retribution of Western sanctions amid the Kremlin’s nearly year-long war in Ukraine. The decision follows steps by Russia in 2022 to slash the bulk of natural gas exported via pipeline to the European Union (EU) – moves that hastened calls…

EIA Says Summer Weather, Production and Economy to Drive 2023 Natural Gas Prices

U.S. natural gas prices are expected to prove volatile through much of 2023, though the lofty $10 handle approached last summer appears far from reach, given ample supplies and the specter of a recession. Such is the assessment of the Energy Information Administration (EIA) in a report released Thursday. In the supplement to its latest…

Weaker Natural Gas Prices, Higher Borrowing Costs Push Inflation Lower

Weakened natural gas prices – following a massive run-up last summer – intersected with rising interest rates to ease inflation that had only a few months ago reached a 40-year high. Further New York Mercantile Exchange gas futures price drops early this year, owing in part to relatively benign winter weather across most of January,…