Kevin Dobbs joined the staff of NGI in April 2020. Prior to that, he worked as a financial reporter and editor for S&P Global Market Intelligence, covering financial companies and markets. Earlier in his career, he served as an enterprise reporter for the Des Moines Register. He has a bachelor's degree in English from South Dakota State University.

Archive / Author

SubscribeKevin Dobbs

Articles from Kevin Dobbs

April Natural Gas Futures Rise Slightly Amid Supply Abundance

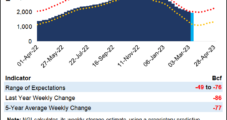

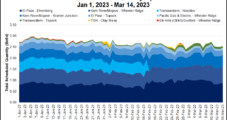

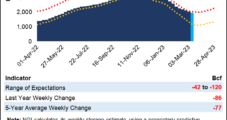

The April Nymex futures contract traded at $2.520 at 11 a.m. ET on Thursday, up 8.1 cents from the previous day’s close. This was after the U.S. Energy Information Administration (EIA) reported a withdrawal of 58 Bcf natural gas from storage for the week ended March 10. At A Glance: BREAKING: U.S. EIA reports 58…

Natural Gas Futures Trade Up Following Latest Light Inventory Draw

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 58 Bcf natural gas from storage for the week ended March 10. The result was well below comparable prints of the recent past but close to market expectations. Nymex natural gas futures forged ahead following the EIA result. Ahead of the 10:30 ET…

Natural Gas Futures, Spot Prices Fall Second Day as Market Braces For Bearish Storage Report

Natural gas futures faltered on Wednesday, a second-consecutive loss, as analysts anticipated another soft government inventory print and traders started to look past a late-winter surge of cold and toward likely benign spring weather. At A Glance: Analysts see modest storage draw Forecasts call for near-term cold Mixed reads on gas production The April Nymex…

April Natural Gas Futures Sputter Despite Weather Support

Natural gas futures fell Tuesday despite mounting weather-driven demand and sliding production. Broader market concerns about inflation and panic in the financial sector helped slow momentum. The April Nymex natural gas futures contract shed 3.3 cents day/day and settled at $2.573/MMBtu. May futures fell 3.6 cents to $2.690. The prompt month had rallied 17.6 cents…

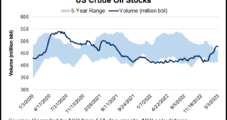

U.S. Crude Production Steady But Off 2023 Peak; Russia Pulls Back

American exploration and production firms’ (E&P) continued to drive oil output at strong levels over the last two weeks, though activity slipped from the highs of the year. E&Ps generated 12.2 million b/d for the week ended March 10, even with the prior week, according to the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status…

Natural Gas Futures Weaken Despite Late-Season Heating Demand; Spot Prices Mixed

Natural gas futures fell Tuesday despite mounting weather-driven demand and sliding production. Broader market concerns about inflation and panic in the financial sector helped slow momentum. The April Nymex natural gas futures contract shed 3.3 cents day/day and settled at $2.573/MMBtu. May futures fell 3.6 cents to $2.690. The prompt month had rallied 17.6 cents…

Natural Gas Futures Rally On Looming Cold Weather; Cash Prices Cruise

Natural gas futures found fresh footing Monday, posting double-digit gains as forecasts pointed to seasonally strong heating demand that more than offset losses late last week. The April Nymex gas futures contract settled at $2.606/MMBtu, up 17.6 cents day/day. It had shed 11.3 cents on Friday. May climbed 16.7 cents on Monday to $2.726. At…

Without More Natural Gas Pipelines, Return to High Prices Could Incent Consumers To Ration Energy Use

Absent a surge in natural gas pipelines and related infrastructure, companies may struggle to get ample supplies to utilities, leaving consumers grappling with either lofty prices or the difficult decision to substantially scale back their energy consumption. Such was the warning from executives and regulators alike during CERAWeek by S&P Global. But they also emphasized…

Natural Gas Futures Rally On Looming Cold Weather; Cash Prices Cruise

Natural gas futures found fresh footing Monday, posting double-digit gains as forecasts pointed to seasonally strong heating demand that more than offset losses late last week. The April Nymex gas futures contract settled at $2.606/MMBtu, up 17.6 cents day/day. It had shed 11.3 cents on Friday. May climbed 16.7 cents on Monday to $2.726. At…

FERC’s Phillips Vows to Approach Infrastructure Project Approvals in ‘Accelerated Way’

FERC Acting Chairman Willie Phillips got the memo. The head of the federal regulatory agency tasked with overseeing energy infrastructure development told a cavernous conference hall filled with industry insiders what they had hoped to hear: Phillips has their back when it comes to speeding up decisions on infrastructure projects. “Building new things,” Phillips said…