Natural Gas Prices | NGI All News Access | Shale Daily

Natural Gas Futures Fail to Find Momentum Amid Steady Production, Weak Demand

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |

Markets

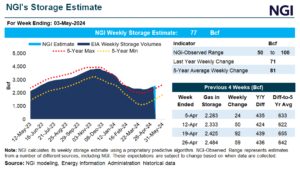

Natural gas futures continued their winning ways on Monday, advancing for a third straight day amid supply curtailments, improving LNG levels and forecasts for late-May heat. At A Glance: Production hovers at 97.5 Bcf/d Feed gas volumes add strength NGI models 77 Bcf storage build After gaining more than 20 cents over the final two…

May 6, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.