Kevin Dobbs joined the staff of NGI in April 2020. Prior to that, he worked as a financial reporter and editor for S&P Global Market Intelligence, covering financial companies and markets. Earlier in his career, he served as an enterprise reporter for the Des Moines Register. He has a bachelor's degree in English from South Dakota State University.

Archive / Author

SubscribeKevin Dobbs

Articles from Kevin Dobbs

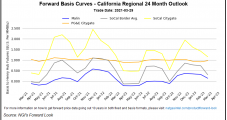

April Natural Gas Bidweek Prices Slump as Weather Demand Dissipates; Outlook Uncertain

Natural gas prices dived lower in April bidweek trading as markets mulled waning weather demand for the month ahead. NGI’s April Bidweek National Avg. fell 51.5 cents month/month to $2.380/MMBtu, led lower by declines across the Midwest, Midcontinent and Northeast regions. The April average marked a substantial increase from NGI’s April 2020 Bidweek National Average…

Betting on Mounting Oil Demand, OPEC and Allies Agree to Boost Production

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, agreed on Thursday to ramp up crude production in anticipation of increased demand. The shift comes despite elevated uncertainty about the coronavirus pandemic and its still festering impacts on global travel and economic activity. Saudi Arabia-led OPEC and an allied group of leading…

May Natural Gas Futures Falter, Despite LNG Momentum

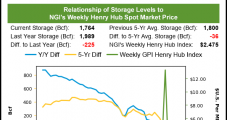

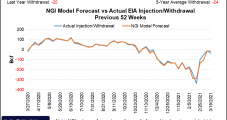

BREAKING: U.S. EIA reports net 14 Bcf injection into natural gas storage for the week ending March 26, coming in slightly below market expectations May Nymex contract settled at $2.608/MMBtu on Wednesday, down 1.5 cents day/day Robust U.S. export activity held at lofty levels, but natural gas futures fell again on Wednesday as traders mulled…

May Natural Gas Futures Dip Lower Amid Weak Domestic Demand Outlook

Robust U.S. export activity held at lofty levels, but natural gas futures fell again on Wednesday as traders mulled domestic demand weakness and the potential for a bearish government inventory report on Thursday. The May Nymex contract settled at $2.608/MMBtu, down 1.5 cents day/day. It declined 3.0 cents a day earlier, its first session as…

As Demand Recovers, Oil Inventories Decline for First Time Since February, EIA Says

U.S. oil inventories decreased for the first time in five weeks as demand rebounded, the U.S. Energy Information Administration (EIA) said Wednesday. In its Weekly Petroleum Status Report, EIA said crude inventories — excluding those in the Strategic Petroleum Reserve — fell by 900,000 bbl from the previous week. Still, at 501.8 million bbl, U.S.…

Cash, LNG Strength Fail to Boost May Natural Gas Futures

Robust U.S. exports climbed higher Cash prices advanced, boosted by Midwest chill But the May contract failed to find momentum Already strong U.S. exports climbed higher Tuesday, but a weakening weather outlook and anticipation of a storage injection kept natural gas futures in check. The May Nymex contract debuted as the prompt month by falling…

May Natural Gas Futures Debut with Thud; Cash Prices Cruise

Already strong U.S. exports climbed higher Tuesday, but a weakening weather outlook and anticipation of a storage injection kept natural gas futures in check. The May Nymex contract debuted as the prompt month by falling 3.0 cents day/day to $2.623/MMBtu. June shed 2.7 cents to $2.681. Cash prices, in contrast, climbed on Tuesday amid a…

Natural Gas Futures Power Forward on LNG Strength, Rising Cash Prices

LNG feed gas volumes approached 11.6 Bcf Cash prices advanced amid chilly rains But domestic weather-driven demand is waning Natural gas futures gained ground Monday. April closed out its run as the prompt month amid forecasts for light domestic demand but robust export volumes. The April Nymex contract settled at $2.586/MMBtu, up 2.9 cents day/day.…

Natural Gas Futures Forge Ahead as April Contract Rolls Off Board; Cash Prices Climb

Natural gas futures gained ground Monday. April closed out its run as the prompt month amid forecasts for light domestic demand but robust export volumes. The April Nymex contract settled at $2.586/MMBtu, up 2.9 cents day/day. May, which becomes the prompt month on Tuesday, advanced 3.4 cents to $2.653. NGI’s Spot Gas National Avg. gained…

April Natural Gas Futures Fade Along With Weather Demand

LNG and Gulf Coast industrial demand prove solid Weather-driven demand light across the Lower 48 Spot prices sputter for a third straight day Despite robust U.S. export levels and signs of stronger Gulf Coast industrial demand, natural gas futures drifted lower on Friday, finishing in the red for only the second time during the trading…