Natural Gas Prices | LNG | Markets | NGI All News Access

Cash, LNG Strength Fail to Boost May Natural Gas Futures

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Markets

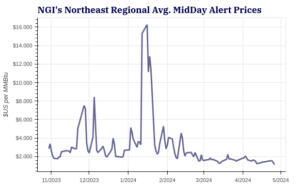

As mild weather threatened to further pad storage surpluses, natural gas futures sagged through midday trading Friday. Meanwhile, spot market buyers seeking supplies for weekend and Monday delivery were finding bargains aplenty. Here’s the latest: June Nymex futures down 7.5 cents to $1.911/MMBtu as of 2:15 p.m. ET From recent levels, natural gas futures face…

April 26, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.