Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

Permian Slowdown Leads Rig Count Lower as 11 Rigs Exit U.S. Oil Patch

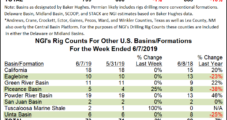

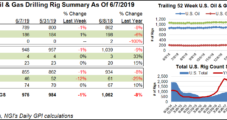

Led by declines in the Permian Basin, the U.S. rig count pulled back sharply during the week ended June 7, falling nine units to finish at 975, according to the latest data from Baker Hughes, a GE Company (BHGE).

Natural Gas Futures Seen Nearing Bottom as Market Digests Another Big Bearish EIA Miss

With traders continuing to mull the implications of a second consecutive large bearish miss from weekly government inventory data, natural gas futures were trading close to even early Friday. The Nymex July futures contract was up 0.4 cents to $2.328/MMBtu just after 8:30 a.m. ET.

NGI The Weekly Gas Market Report

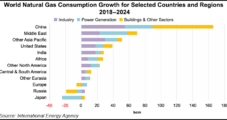

Asia to Power Global Natural Gas Demand Growth to 2024, Says IEA

As the international natural gas trade continues to develop, Asian economies will drive global demand growth over the next five years, according to a new report from the International Energy Agency (IEA).

U.S. Adds Two Natural Gas Rigs; Steep Drop for Oil Patch

The U.S. natural gas rig count gained two units to reach 186 for the week ended June 7, but a drop in oil drilling drove a sharp pullback in the overall domestic drilling tally, according to the latest data from Baker Hughes, a GE Company (BHGE).

Natural Gas Futures Steady Ahead of EIA Report; Another Triple-Digit Build Expected

With traders turning their attention to upcoming Energy Information Administration (EIA) storage data, expected to show another plump weekly injection, natural gas futures were hovering close to even early Thursday. The Nymex July futures contract was trading 0.7 cents lower at $2.371/MMBtu shortly after 8:30 a.m. ET.

Oil Prices Slide Amid Supply, Demand Uncertainties; Domestic Production on the Rise

Crude oil prices have taken a hit in recent weeks amid concerns over global economic growth prospects, just as U.S. production is on track to reach record levels and as recent data points to swelling domestic stockpiles, leaving the market to navigate “rising supply and demand uncertainties,” according to analysts.

Forecasts ‘Much Cooler’ Overnight; Natural Gas Futures Steady Early

Natural gas futures were steady early Wednesday as cooler forecast trends overnight threatened to hamper any potential rebound following recent selling. The Nymex July contract was off 0.2 cents to $2.414/MMBtu shortly after 8:30 a.m. ET.

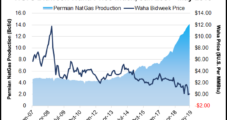

Permian Producers Venting, Flaring Record NatGas Volumes as Prices Tank

As spot prices in the region have languished near or below zero, natural gas flaring and venting in the Permian Basin has climbed to an all-time high, according to new estimates published this week by Rystad Energy.

Canadian Oilsands Growth Set to Slow to 2030 as Constraints Hamper Investment, Says IHS Markit

Total Canadian oilsands production is projected to approach 4 million b/d by 2030, nearly 1 million b/d more than current output, though the rate of growth is set to slow compared to previous years, according to a new 10-year production forecast published by IHS Markit.

‘Massive’ Drop in Daily Production Data Supports Natural Gas Futures Early

With a drop in the latest production data relieving some of the recent downward pressure on natural gas prices, futures were trading slightly higher early Tuesday. At 8:30 a.m. ET, the Nymex July contract was trading 0.7 cents higher at $2.410/MMBtu.